November Pork Export Value Highest in 30 Months; Asia Headwinds Persist for Beef

Fueled by record performances in Mexico, Central America and Colombia, November exports of U.S. pork reached the highest value since mid-2021, according to data released by USDA and compiled by the U.S. Meat Export Federation (USMEF). U.S. beef exports slowed in November, recording the third lowest value of 2023. November lamb exports also trended lower.

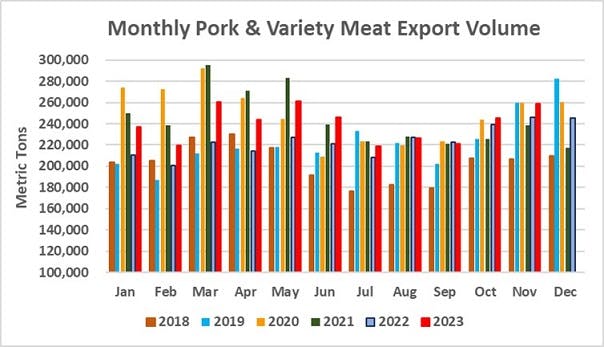

November pork exports totaled 258,601 metric tons (mt), up 5% from a year ago and the highest in six months. Export value was up 2% to $737.4 million, the highest since May 2021 and the seventh highest on record. For January through November, exports totaled 2.64 million mt, up 8% from a year ago, valued at $7.39 billion (up 5%).

“The momentum for U.S. pork exports is remarkable and very broad-based,” said USMEF President and CEO Dan Halstrom. “While Mexico accounts for much of the past year’s export growth, there are success stories throughout the Western Hemisphere and across the entire globe. And the coming year also looks very promising in both established and emerging markets.”

Beef exports totaled 99,029 mt in November, down 14% from a year ago and the second lowest of the year, while value fell 7% to $786.2 million. For the first 11 months of the year, beef exports were 13% below the record pace of 2022 at 1.18 million mt, while value declined 17% to $9.11 billion.

“There are certainly bright spots for U.S. beef, with exports rebounding in Mexico and demand in several Western Hemisphere markets the strongest we’ve seen in years,” Halstrom said. “But economic conditions in our largest Asian markets and the sharp rebound in Australian production and exports have been persistent obstacles over the past year, making it a sharp contrast with the tremendous 2022 performance for U.S. beef exports. Despite these challenges, we still see sustained demand for chilled U.S. beef, and the U.S. remains the dominant supplier of chilled beef entering Korea, Japan and Taiwan.”

With a month to spare, pork exports set numerous annual records

November pork exports to leading market Mexico set a value record at $221.3 million, up 5% from the large total posted a year ago. Export volume (100,313 mt) increased 14% and was the second largest on record, trailing only October 2023. January-November exports already surpassed the annual records set in 2022, with volume increasing 13% year-over-year to 995,534 mt, while value was 15% higher at $2.12 billion.

Mexico’s surging demand for U.S. pork is especially impressive because the market attracted new competition over the past two years. Since mid-2021, Mexico has granted zero-duty access to all eligible pork, beef and poultry suppliers, and this policy has been extended through 2024. The main beneficiaries are European and Brazilian pork, though pork imports from Brazil have been suspended since late November due to a court challenge to Mexico’s import procedures. Even with new players in the arena, the U.S. share of Mexico’s imported pork market increased in 2023, reaching 84%.

Led by outstanding growth in Honduras, Guatemala and El Salvador, pork exports to Central America set monthly volume and value records in November. Shipments increased 35% from a year ago to 16,565 mt, while value surged 37% to $51.3 million. Through the first 11 months of the year, exports increased 15% to 119,348 mt, while value climbed 20% to $352.4 million. Shipments to the region are on a record pace, with exports already setting annual value records in Honduras and Guatemala and both volume and value records in El Salvador and Nicaragua.

November pork exports to Colombia set a value record at $34.3 million, up 59% from a year ago, while November volume was the second largest on record at 12,148 mt (up 46%). After a slow start in 2023, exports to Colombia have strengthened in recent months. For January-November, exports were 6% below the 2022 pace at 88,550 mt, but value increased 6% to $242.2 million. The record performance in Colombia and robust growth in Chile and Peru pushed November pork exports to South America to the largest levels in two years. Shipments increased 55% from a year ago to 15,056 mt, the sixth largest on record, while value jumped 58% to $43.2 million, the third highest on record. Exports to Chile were the largest in 11 years and exports to Peru were the largest since June. Through November, exports to South America were 1% lower in volume (106,968 mt) but increased 8% in value ($306.7 million).

Other January-November results for U.S. pork exports include:

Although November pork exports to the Dominican Republic were slightly below the large totals posted in 2022, monthly exports still surpassed 10,000 mt for just the fifth time. January-November exports to the DR already set an annual record at 91,154 mt, up 20% year-over-year, while value increased 23% to $251.9 million. Shipments to the Caribbean region also set annual records, climbing 20% to 111,010 mt, valued at $322.2 million (up 22%). While this was primarily due to growth in the DR, exports to Caribbean markets outside the DR were the largest in 10 years, with exports on a record pace to the Netherlands Antilles and Leeward-Windward Islands and rebounding strongly to Trinidad and Tobago.

November was an excellent month for pork exports to South Korea, increasing 19% from a year ago to 17,406 mt, while value was up 18% to $57.7 million. January-November shipments increased 4% to 167,349 mt, while value slipped 2% to $551.5 million. Korea’s use of temporary duty-free tariff rate quotas again last year benefited Canadian, Mexican and Brazilian pork. But U.S. share of Korea’s imports increased from 26% to 32%, as the European Union’s market share declined. Imports from the U.S., EU and Chile enter Korea duty-free under trade agreements.

Pork exports to Oceania made an impressive rebound in 2023 and this trend continued in November, with shipments nearly tripling from a year ago to 6,414 mt (up 186%), while value increased 128% to $23.3 million. January-November exports increased 88% in volume (70,021 mt) and 71% in value ($247.8 million).

January-November exports to the ASEAN increased 24% from a year ago to 60,268 mt, though value declined 2% to $142 million. Two emerging markets in the region, both of which have been impacted by African swine fever (ASF), set annual records: exports to Malaysia soared to 4,502 mt valued at $14.3 million, while shipments to Indonesia reached 933 mt valued at $3 million.

November pork exports to Japan were steady with the previous year at 26,890 mt, while value increased slightly to $111.6 million. Through November, exports were down 5% in volume (315,337 mt) and 7% lower in value ($1.29 billion).

Pork exports to China/Hong Kong, which are primarily variety meat, trended substantially lower in November, pushing January-November shipments 4% below the previous year’s pace at 466,511 mt, while value fell 6% to $1.18 billion. China’s live hog price in November averaged $0.93/lb compared to $1.60/lb in November 2022. Larger domestic production and inventories, combined with weak consumer demand, have slowed China’s 2023 import volumes. However, Hong Kong is currently battling a series of ASF outbreaks that has affected local production and could heighten the need for imports in coming months.

November exports of pork variety meat were slightly lower year-over-year, but January-November shipments remained on a record pace, increasing 11% from 2022 to 536,913 mt, valued at $1.26 billion (up 8%). These exports equated to nearly $11 per head slaughtered, also a record pace.

November pork export value equated to $66.20 per head slaughtered, down slightly year-over-year, while the January-November average increased 4% to a record $63.12 per head. Exports accounted for 30.1% of total November pork production and 26.2% for muscle cuts only, each up about one percentage point from a year ago. The January-November ratios were 29.4% of total production and 25.2% for muscle cuts, compared to 27.2% and 23.6%, respectively, in 2022 and matching the record share seen in 2021.

Solid demand for U.S. beef in Western Hemisphere, but struggling in Asia

Beef exports to Mexico posted another impressive performance in November, increasing 3% from a year ago to 17,843 mt and climbing 14% in value to $103.6 million. Through the first 11 months of 2023, exports to Mexico rebounded 14% in volume to 189,242 mt and an impressive 24% in value to $1.08 billion – already surpassing the full-year totals from 2022. This included a 16% increase in beef variety meat exports, to 98,330 mt, with value up 20% to $286.5 million.

November beef exports to Central America were steady with a year ago at 1,940 mt, while value increased 20% to $15.1 million, the highest in two years. For January through November, exports to the region edged 1% higher than a year ago to 19,027 mt, while value increased 5% to $135.4 million. Exports to leading market Guatemala were up 5% to 8,471 mt, while value increased 14% to $66.8 million. In Honduras, shipments increased 10% to 2,294 mt and soared 33% higher in value to just under $13 million. Both of these markets have already set annual value records and are on a record volume pace. Export volume to El Salvador is also on a record pace.

Despite lower shipments to leading market South Africa, November beef exports to Africa nearly doubled from a year ago to 1,221 mt (up 97%), while value was 33% higher at $1.5 million. Growth was led by Angola, Cote D’Ivoire and Gabon. January-November shipments to Africa increased 60% to 19,364 mt, valued at $24 million (up 28%). About 98% of these shipments are beef variety meat, mainly livers and kidneys.

Other January-November results for U.S. beef exports include:

While Taiwan’s demand for U.S. beef is below the record levels of 2022, it has proven more resilient than other major Asian markets. Through November, exports to Taiwan were down 6% year-over-year to 56,629 mt, while value fell 17% to $580.4 million. U.S. beef still dominates Taiwan’s chilled beef market, capturing 75% market share.

November beef shipments to the Dominican Republic were below year-ago levels but January-November volume remained 1% above the year-ago pace at 8,531 mt. Export value to the DR, which is on a record pace, increased 8% to $95.7 million. Exports to the Caribbean region increased 5% in value to $228.4 million, despite trending lower in volume (24,538 mt, down 6%). The Bahamas and Netherlands Antilles have set annual value records, while export value is also on a record pace for Turks and Caicos.

Beef exports to Hong Kong, where demand has strengthened with the recovery in business travel and tourist visits from mainland China, increased slightly in November to 3,406 mt, though value was down 4% to $35.4 million. January-November shipments to Hong Kong increased 12% to 36,397 mt, while value increased 3% to $379.2 million.

While still trending lower for the year, November beef exports to South America were the largest since mid-2022 at 2,302 mt, up 33% year-over-year. Export value increased 7% to $12 million. Through November, exports to South America were down 15% year-over-year to 20,294 mt, while value fell 20% $109.8 million.

The positive results in the above-mentioned markets were offset by lower demand in U.S. beef’s three largest export destinations: South Korea, Japan and China. Through November, exports to Korea were 17% below the record pace of 2022 at 225,235 mt, while value was down 24% to $1.91 billion. Exports to Japan declined 22% to 224,489 mt, with value also falling 24% to $1.67 billion. Shipments to China were down 24% in volume (174,901 mt) and 27% in value ($1.48 billion). Product shipped in late 2022 was still clearing into these markets in 2023, U.S. beef prices were increasing at a time that competitors’ prices were falling, and consumers were pinched by sustained inflationary pressures, which also contributed to a lack of consumer confidence. These negative factors should ease in 2024, but marketing the value attributes of U.S. beef will remain critical.

November beef export value equated to $380.54 per head of fed slaughter, down slightly year-over-year. The January-November average fell 13% to $394.07 per head but was still the third highest on record, trailing only 2021 and 2022. Exports accounted for 12.7% of total November beef production and 10.4% for muscle cuts only, each about one percentage point lower than a year ago. The January-November ratios were 13.9% of total production and 11.7% for muscle cuts, compared to 15.3% and 13.1%, respectively, in 2022.

Lamb exports still trending lower

November exports of U.S. lamb totaled 115 mt, down 64% from a year ago, while value fell 50% to $817,000. January-November exports were 18% below the previous year’s pace at 2,169 mt, while value was 17% lower at $11.5 million. Exports trended higher to Guatemala, the Netherlands Antilles and Barbados, but these gains were offset by lower shipments to Mexico and Canada.

Complete January-November export results for U.S. pork, beef and lamb are available from USMEF's statistics web page.

For questions, please contact Joe Schuele or call 303-547-0030.

NOTES:

Export statistics refer to both muscle cuts and variety meat, unless otherwise noted.

One metric ton (mt) = 2,204.622 pounds.

U.S. pork and beef currently face retaliatory duties in China. In February 2020, China announced a duty exclusion process that allows importers to apply for relief from duties imposed in response to U.S. Section 301 duties. When an application is successful, the rate for U.S. beef can decline to the MFN rate of 12% and the rate for U.S. pork can decline to 37% (the MFN rate plus the 25% Section 232 retaliatory duty, which remains in place).