Red Meat Exports Trend Higher in March; Beef Export Value Highest in Nine Months

Exports of U.S. beef, pork and lamb trended higher year-over-year in March, according to data released by USDA and compiled by the U.S. Meat Export Federation (USMEF). Beef export value was the highest since June, while Latin American markets again fueled pork export growth. March exports of lamb muscle cuts were the largest in more than five years.

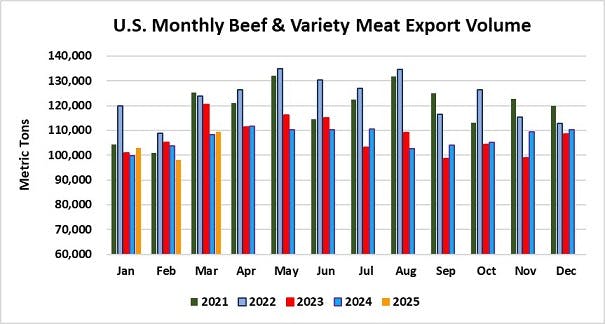

March beef exports totaled 109,330 metric tons (mt), up 1% from a year ago, while export value reached $922 million – up 4% and the highest since June. First-quarter exports were slightly below last year’s pace at 310,368 mt, but increased 2% in value to $2.53 billion.

“Despite a great deal of uncertainty, global demand for U.S. beef remains robust and resilient,” said USMEF President and CEO Dan Halstrom. “The March export results confirm this, with demand trending higher in Taiwan and Mexico, reaching record levels in Central America and holding up well in Japan and Korea. Although we anticipate that China’s retaliatory tariffs and expired plant registrations will have a more drastic impact on April and May exports, the U.S. industry’s efforts to diversify markets and broaden U.S. beef’s global footprint are definitely paying dividends.”

March pork exports increased 3% year-over-year to 269,344 mt, valued at $769.7 million (up 4%). First-quarter exports were slightly above last year’s record value pace at $2.11 billion, but slightly lower in volume (754,488 mt).

“March was another spectacular month for U.S. pork demand in Mexico and Central America, but exports also rebounded nicely to Colombia and Korea,” Halstrom said. “Duty-free access has helped fuel pork exports to these key markets, where we continue to see heightened competition.”

Plant eligibility for China is less of an issue for U.S. pork than for U.S. beef, as China renewed most pork establishments in mid-March. But Halstrom cautioned that both pork and beef exports to China have since hit a wall due to China’s prohibitive duties, which now total 172% for U.S. pork and 147% for U.S. beef.

“Shipments already in the pipeline can still clear without the extra 125% tariff, provided they shipped before April 10 and arrive in China by May 13,” Halstrom explained. “But new business has been effectively halted until there is a de-escalation of the U.S.-China trade impasse.”

Taiwan, Mexico, Central America fuel March beef export growth

March was a bounceback month for U.S. beef exports to Taiwan, which jumped 34% from a year ago to 5,086 mt, while export value climbed 33% to $60.5 million. These results pushed first-quarter exports to Taiwan 1% above last year’s pace at 12,212 mt, while export value climbed 11% to $147.6 million. The U.S. is the dominant supplier of high-value chilled beef in Taiwan, capturing 72% of the chilled import market.

Beef exports to Mexico also closed the first quarter on a high note, increasing 6% from a year ago in March to 17,592 mt, while export value climbed 7% to $110.9 million. For January through March, shipments to Mexico were 3% below last year’s pace at 54,861 mt, while value was steady at $332.7 million. Mexico is the leading volume destination for U.S. beef variety meat, including large volumes of tripe, lips and hearts. First-quarter variety meat shipments increased 5% from a year ago in volume (30,162 mt) and 6% in value ($81.6 million).

Coming off a record year in 2024, beef exports to Central America continue to gain momentum. Led by growth in Guatemala and Panama, March exports to the region increased 23% from a year ago to 2,158 mt, valued at $19.8 million (up 29%). First-quarter exports were 5% above last year at 6,018 mt, with exports to Costa Rica and Panama on a record pace. Value climbed an impressive 24% to $52.5 million, led by a record value pace in Guatemala, Panama, Costa Rica and Honduras.

Other first-quarter results for U.S. beef exports include:

March beef exports to Japan were steady with last year in both volume (21,683 mt) and value ($168.5 million). For January through March, exports were down 5% to 59,846 mt, valued at $451.8 million (down 4%). This is largely due to a sharp decline in beef variety meat exports – mainly tongues and skirts – which fell 16% to 9,299 mt, valued at $91.3 million (down 24%).

Beef exports to South Korea trended modestly lower in March, declining 6% to 20,838 mt, while value fell 2% to $206.2 million. First-quarter exports to Korea, which is the leading value destination for U.S. beef, were slightly below last year’s volume pace at 58,179 mt, but increased 3% in value to $568.4 million.

Ahead of the March 16 expiration of most U.S. beef-producing plants’ eligibility for China, exports managed a slight increase over last year at 15,907 mt, while value was up 5% at $141.5 million. First-quarter exports to the China/Hong Kong region increased 4% to 53,039 mt, while value was steady at $468.7 million.

Led by an uptick in variety meat demand in Cote D’Ivoire, Morocco and Gabon, beef exports to Africa gained momentum in March, climbing 73% from a year ago in volume (1,550 mt) and more than doubling in value ($2.9 million, up 123%). These strong results pushed first-quarter exports 15% above last year at 3,658 mt, while value increased 34% to $5.8 million. First-quarter beef variety meat exports to Morocco, which were mostly livers, were record-large at 1,146 mt. Variety meat shipments were the largest in 12 years to Cote D’Ivoire (1,210 mt) and the largest in five years to Gabon (990 mt). USMEF recently led a trade mission to West Africa, which attracted buyers from a dozen countries to a two-day seminar in Accra, Ghana. More details are available from the USMEF website.

While beef exports to South America have trended lower in 2025, leading market Chile is a notable exception. March shipments to Chile surged to 810 mt, up 161% from a year ago, valued at $5.6 million (up 155%). First-quarter exports to Chile increased 41% to 2,021 mt, while value soared 77% to $14.1 million. Beef variety meat exports to Chile, mostly livers and tripe, are on a record pace at 1,173 mt, up 47% from last year.

March beef exports equated to $466.77 per head of fed slaughter, the seventh highest on record and topping last March’s robust average by 3%. The first-quarter per-head average was also up 3% to $421.56. Exports accounted for 14.8% of total March beef production and 12.5% for muscle cuts only – each down slightly from a year ago. First-quarter ratios were 13.8% of total production and 11.6% for muscle cuts, also down slightly from last year.

March pork demand shines in Mexico and Central America, rebounds in Colombia

March was another spectacular month for U.S. pork exports to Mexico, which increased 14% from a year ago to 96,723 mt. Export value soared 19% to $213.1 million – the ninth consecutive month that value has exceeded $200 million. Through the first quarter, pork exports to Mexico topped last year’s record pace by 5% at 294,403 mt, with value climbing 11% to $637.7 million.

While trade relations with Mexico have been relatively stable in 2025, USMEF is closely monitoring the U.S. Commerce Department’s plan to impose a 21% antidumping duty on tomatoes imported from Mexico, effective July 14. Mexico has not published a retaliation list, but U.S. pork has been mentioned as a potential target.

Fueled by monthly records for Honduras and Guatemala, March pork exports to Central America increased 21% from a year ago to 16,493 mt, while value increased 22% to $51.8 million. First-quarter shipments to the region were 20% above last year’s record pace at 45,167 mt, valued at $141.7 million (up 23%). First-quarter exports established a record volume pace to Honduras, Guatemala, Costa Rica and Nicaragua.

After a slow start in 2025, March pork exports to Colombia surged to the second highest monthly volume on record, climbing 39% from a year ago to 14,342 mt, while export value soared 44% to $41.3 million. First-quarter shipments to Colombia climbed 4% above last year’s record pace at 33,264 mt, while value increased 9% to $96 million.

Other first-quarter results for U.S. pork exports include:

Although March pork exports to South Korea were well below the enormous totals posted a year ago, the market actually achieved a significant rebound. March shipments to Korea totaled 23,882 mt, down 13% year-over-year but the largest since April. While export value declined 15% to $77.4 million, this was the highest total since May. First-quarter exports to Korea totaled 58,214 mt, which was down 16% from last year’s pace when exports were the highest since 2018. Value fell 18% to $186.7 million.

March pork exports to China/Hong Kong were steady with last year in volume at 41,000 mt, while value increased 3% to $99.1 million. For the first quarter, exports to the region increased 3% to 117,087 mt, with value up 7% to $284.6 million. Variety meat exports to China accounted for about two-thirds of this total (77,440 mt, valued at $190.6 million), as China is the leading destination for U.S. pork variety meat. As noted above, production of pork variety meats for China has now mostly stopped due to prohibitive duties. While the U.S. industry has made it a priority to diversify markets for pork variety meat, China’s demand cannot be fully replaced.

U.S. pork is performing well in the Philippines, where domestic pork production has been heavily impacted by African swine fever. March shipments to the Philippines increased 9% from a year ago to 5,050 mt, while value climbed 26% to $11.6 million. First-quarter exports increased 15% to 12,821 mt, while value climbed 39% to $29.5 million.

Demand for U.S. pork continues to climb in Cuba, where March exports increased 57% from a year ago to 1,068 mt, valued at $2.9 million (up 32%). For the first quarter, exports to Cuba doubled from a year ago to 3,346 mt, while value climbed 107% to $10.2 million.

March pork exports to Japan were 6% below last year at 30,163 mt, while value fell 8% to $119.1 million. First-quarter exports to Japan were 14% below last year in volume (75,843 mt) and 15% lower in value ($304.8 million).

March pork exports equated to $73.91 per head slaughtered, up 4% from a year ago and the second highest on record, trailing only May 2021. The first-quarter average was up 2% to $65.82 per head. Exports accounted for 33.2% of total March pork production and 29% for muscle cuts only – each about one percentage point higher than a year ago. First-quarter ratios were 30.2% of total production and 26.3% for muscle cuts, up from 29.9% and 25.8%, respectively, a year ago.

March lamb exports largest since 2019

Exports of U.S. lamb muscle cuts totaled 278 mt in March, up 45% from a year ago and the largest since December 2019. Export value increased 18% to $1.5 million. Through the first quarter, exports increased 26% year-over-year to 747 mt, while value was up 10% to $4.1 million. Growth was driven primarily by Mexico and the Caribbean, with Trinidad and Tobago shining among Caribbean markets. Exports also trended higher to Central America.

Complete January-March export results for U.S. pork, beef and lamb are available from USMEF’s statistics web page.

For questions, please contact Joe Schuele or call 303-547-0030.

NOTES:

Export statistics refer to both muscle cuts and variety meat, unless otherwise noted.

One metric ton (mt) = 2,204.622 pounds.

U.S. pork and beef currently face retaliatory duties in China. In February 2020, China announced a duty exclusion process that allows importers to apply for relief from duties imposed in response to U.S. Section 301 duties. When an application is successful, the rate for U.S. beef can decline to the MFN rate of 12% and the rate for U.S. pork can decline to 37% (the MFN rate plus the 25% Section 232 retaliatory duty, which remains in place). But China imposed an additional 10% retaliatory duty on U.S. pork and beef on March 10, 2025, and additional retaliatory duties were announced in April 2025. China’s new retaliatory duties were first announced at 34% but were later increased to 84% and further increased to 125%. The additional tariffs pushed China’s effective duty rate on U.S. pork and pork variety meat to 172% and beef and beef variety meat are now tariffed at 147%. These rates represent the sum total of China’s 12% most-favored-nation tariff, plus retaliatory duties previously imposed by China, plus all recently announced retaliatory duties.

Since March 4, 2025, most U.S. sausages entering Canada have been subject to a 25% retaliatory duty.