U.S. Pork and Beef Export Volumes Strong in July; Pork Value Squeezed by Higher Duties

July exports of U.S. pork and beef were higher than a year ago, according to data released by USDA and compiled by USMEF. Export value results were mixed, with beef exports posting another near-record month while pork export value declined, reflecting the impact of retaliatory duties imposed by Mexico and China.

Pork exports totaled 176,413 metric tons (mt) in July, up 1.5 percent from a year ago, valued at $465.3 million – down 5 percent year-over-year and the lowest monthly value since February 2016. For the first seven months of the year, pork exports remained 2 percent ahead of last year’s record volume pace at 1.45 million mt, while value was up 3 percent to $3.83 billion.

“It is encouraging to see pork export volume continue to grow, even in the face of considerable headwinds in some of our most critical markets,” said USMEF President and CEO Dan Halstrom. “But as anticipated, the 20 percent duty in Mexico and 62 percent duty in China weigh heavily on the price these exports can command and on the returns generated for producers and for everyone in the U.S. supply chain. Buyers outside of Mexico and China have stepped up to purchase our product, which is fantastic. But they are capitalizing on a buying opportunity made possible by the higher costs of doing business in Mexico and China.”

July exports accounted for 24.7 percent of total pork production and 21.7 percent for muscle cuts only, down from 25.9 percent and 21.3 percent, respectively, last year. For January through July, the percentage of total pork production exported fell from 27.5 to 27 percent, but for muscle cuts the percentage increased from 22.8 to 23.3 percent. July pork export value averaged $48.49 per head slaughtered, down 11 percent from a year ago. Through July, per-head export value was up slightly to $54.27.

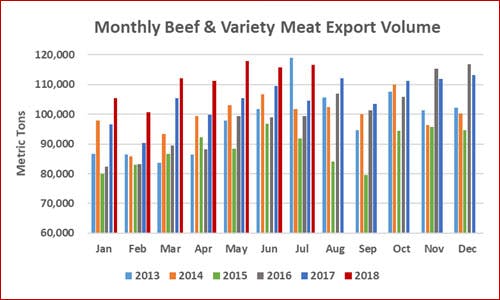

Led by another spectacular performance in South Korea and strong growth in Japan, Taiwan and Latin America, July beef exports climbed 12 percent in volume to 116,575 mt, valued at $722 million – up 16 percent from a year ago and just slightly below the May 2018 record of $722.1 million. For January through July, beef exports established a record pace in both volume (779,450 mt, up 10 percent year-over-year) and value ($4.76 billion, up 20 percent).

July exports accounted for 14 percent of total beef production and 11.8 percent for muscle cuts only (the highest since December 2016) – each up nearly a full percentage point from a year ago. For January through July, exports accounted for 13.5 percent of total beef production and 11.1 percent for muscle cuts – up from 12.8 percent and 10.1 percent, respectively, last year. Beef export value averaged $326.18 per head of fed slaughter in July, up 9 percent from a year ago. Through July, per-head export value was up 16 percent to $318.31.

“The worldwide momentum for U.S. beef has rarely been as strong as it is today,” Halstrom said. “To a large degree our mainstay Asian markets are driving this growth, but emerging markets in Asia and in the Western Hemisphere are also displaying a tremendous appetite for U.S. beef and contributing significantly to the surge in export value. From high-end restaurants to convenience stores, U.S. beef is gaining new fans across the globe on a daily basis.”

Pork exports show resilience, but July value suffers due to trade headwinds

The duty rate on most U.S. pork entering Mexico increased from zero to 10 percent in early June and from 10 to 20 percent in early July. This took a toll on July exports to Mexico, especially in terms of value. July volume was 56,484 mt, down just 4 percent from a year ago. But pork moved south at lower prices, with value falling 25 percent to $92 million.

In China, the duty rate on U.S. pork and pork variety meat increased from 12 percent to 37 percent on April 1, and to 62 percent on July 6. July exports to the China/Hong Kong region totaled 22,199 mt, down 31 percent from a year ago, while value dropped 19 percent to $55.9 million. Pork variety meat volume to China was hit especially hard in July, dropping 49 percent from a year ago to 7,446 mt. For January through July, pork and pork variety exports to China/Hong Kong dropped 22 percent year-over-year in volume (238,207 mt) and 10 percent in value ($563 million) – due in part to the higher duty rates, but also due to an upward trend in China’s domestic pork production.

The July export picture was much brighter in other major markets – including Japan, the leading value destination for U.S. pork. Exports to Japan totaled 31,248 mt in July, up 10 percent from a year ago, while value climbed 6 percent to $127.2 million. For January through July, exports to Japan were 1 percent ahead of last year’s pace in volume (230,315 mt) and 2 percent higher in value ($948.6 million). This included a 2 percent decline in chilled pork exports to 120,288 mt, though chilled pork value increased 1 percent to $580.4 million.

Other January-July highlights for U.S. pork include:

- Korea is the growth pacesetter for U.S. pork in 2018, with exports up 44 percent from a year ago in volume (148,233 mt) and 50 percent in value $424.3 million. The U.S. has supplied 40 percent of Korea’s imported chilled/frozen pork this year, up from 36 percent in 2017. U.S. pork dominates Korea's imports of picnics and butts while Europe supplies most of the bellies. But Korea is also importing more of a wider range of U.S. pork cuts, including loins, hams and ribs.

- Fueled by strong results in Colombia and Peru, pork exports to South America increased 30 percent in volume (73,003 mt) and 26 percent in value ($180.3 million). Although year-to-date pork exports to Chile were down 7 percent, exports gained momentum in July and were the second largest on record at 4,103 mt. U.S. pork also recently gained access to Argentina, which could further boost exports later in the year.

- Double-digit growth in all seven Central American nations pushed pork exports to the region 19 percent above last year’s pace in volume (46,020 mt) and 18 percent higher in value ($108.9 million). Honduras and Guatemala are the leading destinations, but U.S. pork continues to gain momentum throughout Central America.

- The Dominican Republic has also been a top growth market this year, with exports up 22 percent in volume to 25,985 mt and value up 19 percent to $56.7 million. This included a 79 percent increase in July volume (3,718 mt), with July value up 42 percent to $7.2 million.

- In Oceania, a critically important market for U.S. hams used for further processing, exports climbed 7 percent in volume (49,649 mt) and 9 percent in value ($145.7 million), with exports trending higher to both Australia and New Zealand.

- With strong growth to the Philippines and shipments to Vietnam more than tripling from a year ago, exports to the ASEAN region climbed 23 percent higher in volume (32,888 mt) and 25 percent higher in value ($85.9 million).

Beef export value reaching new heights in wide range of markets

U.S. beef exports to Japan hit a post-BSE volume high in July, reaching 31,883 mt (up 15 percent from a year ago) valued at $196.3 million (up 12 percent). For January through July, exports were up 7 percent in volume (191,237 mt) and 12 percent in value ($1.21 billion). This included a 4 percent increase in chilled beef exports to 87,034 mt valued at $694.9 million (up 13 percent). U.S. beef has captured 50 percent of Japan’s chilled import market this year, down slightly from a year ago.

Beef export growth to Korea continued at a remarkable pace in July, with volume up 51 percent from a year ago to 23,614 mt and value soaring 66 percent to $169.2 million. This shattered the previous monthly value record of $154.8 million, set in June 2018. For January through July, exports to Korea jumped 38 percent to 136,897 mt, valued at $971.2 million (up 54 percent). This included a 33 percent increase in chilled beef exports to 29,923 mt, valued at $289.2 million (up 45 percent). U.S. beef has accounted for 58 percent of Korea’s chilled beef imports this year and 53 percent of the chilled/frozen total (up from 54 percent and 47 percent, respectively, during the same period last year). Australia is expected to trigger its beef safeguard in the coming weeks, resulting in a temporary tariff rate increase agreed to in the Korea-Australia Free Trade Agreement. This could further strengthen momentum for U.S. chilled beef to Korea through the end of this year.

Other January-July highlights for U.S. beef include:

- Although export volume to China/Hong Kong slowed in July, the January-July total was still up 10 percent from a year ago to 72,193 mt, while value climbed 37 percent to $572.9 million. Efforts to build a presence for U.S. beef in China have been hampered by retaliatory duties, which increased the tariff rate from 12 to 37 percent in early July. January-July exports to China were 4,138 mt valued at $36.4 million.

- U.S. beef is enormously popular in Taiwan, where the United States captures nearly 75 percent of the chilled beef market. July export volume was record-large at 5,640 mt, up 46 percent from a year ago, while value climbed 32 percent to $48 million. Through July, exports to Taiwan increased 34 percent from a year ago in volume (32,504 mt) and 38 percent in value ($297.7 million). Chilled beef exports totaled 13,040 mt (up 32 percent) valued at $161.3 million (up 41 percent).

- Despite recent trade tensions and uncertainty, beef exports to Mexico have been very solid in 2018, with volume up 2 percent from a year ago to 137,560 mt and value up 9 percent to $596.5 million. For muscle cuts only, exports increased 10 percent in volume to 80,450 mt and 11 percent in value to $465.7 million.

- Strong growth in the Philippines helped push beef exports to the ASEAN region 9 percent higher in volume (25,520 mt) and 24 percent higher in value ($141.6 million). Exports to Singapore and Indonesia have also increased this year, though volumes to Indonesia slowed the past two months.

- In Central America, larger volumes to Costa Rica, Guatemala, and Panama pushed exports 29 percent higher in volume (8,320 mt) and 28 percent higher in value ($45.4 million). Despite a modest decline in volume, export value also increased to Honduras.

Lamb exports still climbing

U.S. lamb exports continue to rebound from last year’s low totals as July volume jumped 104 percent from a year ago to 1,209 mt and value increased 46 percent to $2.17 million. Through July, lamb exports increased 54 percent in volume (6,680 mt) and 21 percent in value ($13.44 million). While much of this growth is attributable to stronger lamb variety meat demand in Mexico, muscle cut exports trended higher to the Caribbean, the United Arab Emirates, the ASEAN region and Taiwan.

Complete export results for U.S. beef, pork and lamb are available from USMEF’s statistics web page.

If you have questions, please contact Joe Schuele at jschuele@usmef.org or call 303-547-0030.

NOTES:

- Export statistics refer to both muscle cuts and variety meat, unless otherwise noted.

- One metric ton (mt) = 2,204.622 pounds.

Posted 9/6/2018