Strong Momentum Continues for U.S. Beef Exports; Pork Exports Trend Lower

Coming off a record-breaking performance in 2021, U.S. beef exports remained red-hot in January, according to data released by USDA and compiled by USMEF. Pork exports continued to trend lower in January, despite another outstanding month for exports to leading market Mexico.

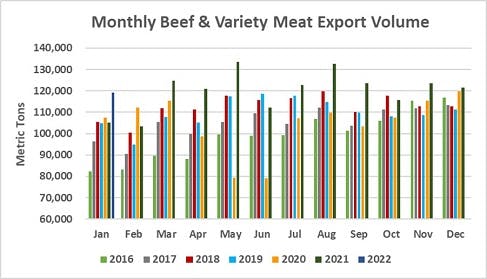

Beef exports totaled 119,066 metric tons (mt), up 13% from a year ago, while value soared 57% to $1.03 billion. This was the third-highest value total on record – trailing only August and November of last year – and export value per head of fed slaughter set a new record, topping $500 for the first time.

"This is a truly remarkable run for U.S. beef exports, and the momentum is not limited to our large Asian markets," said USMEF President and CEO Dan Halstrom. "Regions such as Central America and the Caribbean contributed significantly to January export growth, and export value made strong gains in the Middle East."

January pork exports totaled 208,808 mt, down 16% from a year ago, while export value fell 14% to $555.6 million.

As expected, the continued rebound in China's pork production has slowed demand for U.S. pork, but Halstrom also noted the impact of additional headwinds.

"We have spoken often over the past year about port congestion and other logistical challenges, and shipping costs are heavily impacting the U.S. pork industry's ability to serve certain markets," he said. "Australia, for example, has been a very reliable destination for U.S. hams for further processing, but shipping raw material to Oceania is becoming cost-prohibitive. The low price of European pork is also impacting demand in other further-processing markets such as Southeast Asia and Taiwan. This underscores the importance of our Western Hemisphere markets, where the U.S. industry continues to pursue new strategies for increasing pork consumption and expanding demand. It is also a reminder that the U.S. industry must continue to strive for market diversification, so we are well-prepared for shifts in the competitive landscape."

Huge month for Korea pushes January beef exports past $1 billion milestone

Beef exports to South Korea reached a record $2.38 billion in 2021, and demand didn't miss a beat in January. Exports to Korea climbed 39% from a year ago to 29,578 mt, while export value nearly doubled to a record $316.5 million (up 99%). While U.S. beef's pandemic-era growth in Korea has been largely driven by soaring retail demand, the foodservice outlook is also brightening as health officials recently loosened social distancing requirements and allowed longer operating hours for restaurants. Korea's tariff rate on U.S. beef, which was 40% before the Korea-U.S. Free Trade Agreement entered into force, dropped to 10.7% this year and will reach zero at the end of 2026.

Demand for U.S. beef in China/Hong Kong remained strong in January, climbing 69% from a year ago to 19,772 mt, while export value more than doubled ($194.2 million, up 115%). USMEF projects continued growth for U.S. beef in the region this year, though at a more moderate rate than in 2021 when export volume increased 87% year-over-year to more than 240,000 mt. Meaningful access to China – which was first achieved in early 2020 through the Phase One Economic and Trade Agreement – is also a supportive factor in the prices U.S. beef cuts command in other Asian markets.

January beef exports to Japan were up 4% from a year ago at 22,936 mt, while value jumped an impressive 32% to $181.7 million. Exports were bolstered by a strong performance for beef variety meat – mainly tongues and skirts – which increased 20% in volume (4,367 mt) and 69% in value ($41.8 million).

Other January results for U.S. beef exports include:

- Exports to Taiwan raced to a fast start in 2022, climbing 80% to 6,914 mt, while export value jumped 115% to $83 million. However, the large increase in January was due in part to delayed shipments that would normally have arrived before the end of the year.

- Beef exports to the Middle East were relatively steady in volume (6,761 mt, down 1%) but increased 29% in value to $26.3 million, led by strong value growth in Egypt, the United Arab Emirates and Kuwait.

- Led by excellent value growth in Japan, Egypt, Mexico, China/Hong Kong, Vietnam, Gabon and Honduras, beef variety meat exports increased 36% in value to $93 million, despite a 3% drop in volume (22,977 mt).

- A rebound in foodservice demand helped beef exports to the Caribbean climb 28% from a year ago to 1,857 mt, while value doubled to $17 million, led by strong results in the Dominican Republic, Jamaica and the Bahamas.

- Beef exports to Central America continued to expand in January, increasing 14% from a year ago to 1,803 mt, while value jumped 45% to $13.1 million.

- January beef export value equated to a record $503.68 per head of fed slaughter, up 62% from a year ago and topping $500 for the first time. Exports accounted for 15.4% of total beef production and 13.3% for muscle cuts, up substantially from the year-ago ratios of 13.3% and 11%, respectively.

Bright spots for January pork exports include Mexico, Korea, Dominican Republic

Last year Mexico reclaimed its position as the leading destination for U.S. pork exports, taking nearly 875,000 mt valued at $1.68 billion. This strong performance continued in January, with exports climbing 36% from a year ago to 87,027 mt, valued at $136.6 million (up 24%). With the tight U.S. labor situation, Mexico is an especially attractive market for bone-in hams for further processing. U.S. pork also continues to make impressive strides in Mexico's retail and foodservice sectors.

While January pork exports to South Korea declined slightly year-over-year (15,729 mt, down 1%), the upward trend in value continued as export value reached $58.4 million (up 30% and the highest since May). Korea is importing larger volumes of chilled pork from the U.S. and Canada – its two largest chilled suppliers – and the U.S. industry continues to capitalize on Koreans' growing demand for home meal replacement items and other convenience-based products.

With strong consumer demand in the Dominican Republic and domestic pork production challenged by African swine fever (ASF) outbreaks, pork exports to the DR reached new heights in 2021 and made a strong showing in January, climbing 23% in volume (6,408 mt, the second highest on record) and 17% in value ($14.2 million). Exports also increased to the Bahamas and the Leeward-Windward Islands, pushing January exports to the Caribbean 17% higher year-over-year to 7,473 mt, valued at $17.9 million (up 16%).

Other January results for U.S. pork exports include:

- Exports to China/Hong Kong were in line with USMEF's projections, but dropped significantly from a year ago in both volume (35,456 mt, down 53%) and value ($97.7 million, down 44%). This region remains the dominant destination for U.S. pork variety meat and while January variety meat exports were down 13% to 21,332 mt, export value still climbed 7% to $62 million.

- January exports to Japan dipped 18% from a year ago to 26,452 mt, with value down 12% to $118.7 million. The decline was due in part to shipping challenges, and the volume of ground seasoned pork shipped to Japan was also impacted by a price gap between U.S. and European product.

- While pork exports trended lower to Central America, shipments to Costa Rica increased 12% from a year ago in volume (1,201 mt) and 2% in value ($3.4 million). Exports to El Salvador jumped 20% to 1,034 mt, valued at $3 million (up 35%).

- January shipments of U.S. pork variety meat declined 13% from a year ago to 35,121 mt, but exports still gained 2% in value ($93.6 million). In addition to the increase posted in China/Hong Kong, variety meat export value was also higher year-over-year to Canada, Japan, Korea, the DR and Central America.

- January pork export value equated to $53.37 per head slaughtered, down 7% from a year ago. Exports accounted for 25.5% of total pork production and 22.8% for muscle cuts, each down about 2.5 percentage points from a year ago.

Lamb exports trend higher, led by strong demand in Mexico

January exports of U.S. lamb totaled 1,533 mt, up 49% from a year ago, while export value climbed 59% to $1.9 million. Variety meat exports to leading market Mexico accounted for $1.3 million of the value total, a year-over-year increase of 73% and a new monthly record. Variety meat volume to Mexico was the fourth largest on record at 1,444 mt, up 53%. Lamb muscle cut exports to Mexico also increased substantially, with muscle cut demand also posting gains in the Caribbean and Panama.

Complete January export results for U.S. pork, beef and lamb are available from USMEF's statistics web page.

For questions, please contact Joe Schuele or call 303-547-0030.

NOTES:

- Export statistics refer to both muscle cuts and variety meat, unless otherwise noted.

- One metric ton (mt) = 2,204.622 pounds.

- U.S. pork and beef currently face retaliatory duties in China. In February 2020, China announced a duty exclusion process that allows importers to apply for relief from duties imposed in response to U.S. Section 301 duties. When an application is successful, the rate for U.S. beef can decline to the MFN rate of 12% and the rate for U.S. pork can decline to 37% (the MFN rate plus the 25% Section 232 retaliatory duty, which remains in place).