Record Value for July Beef Exports; Pork Value also Strong

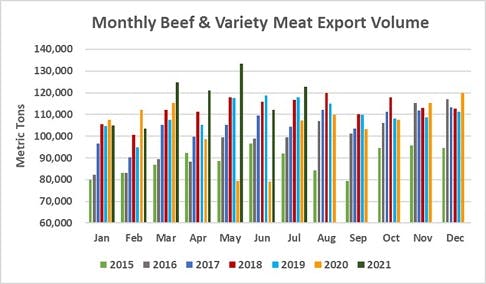

U.S. beef exports set another new value record in July, according to data released by USDA and compiled by the U.S. Meat Export Federation (USMEF). July export value climbed 45% from a year ago to $939.1 million, while volume was the third largest of the post-BSE era at 122,743 metric tons (mt), up 14% year-over-year.

For January through July, beef exports increased 18% from a year ago to 822,830 mt, with value up 30% to $5.58 billion. Compared to the pace established in 2018, the record year for U.S. beef exports, shipments were up 6% in volume and 17% in value.

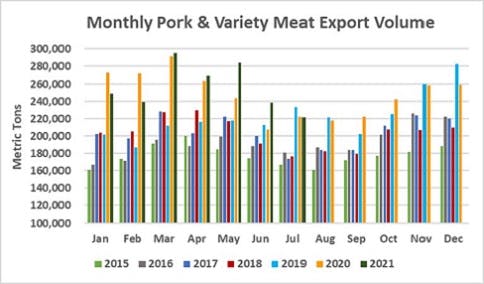

July pork exports were steady with last year at 221,809 mt, but export value jumped 20% to $657.3 million. Pork variety meat exports were especially strong at 49,092 mt, up 54% from the low total posted a year ago and 16% above July 2019. Variety meat export value was the second highest on record at $116.7 million, up 69% from a year ago and 39% above 2019.

For January through July, pork exports were 1% above last year's record pace at just under 1.8 million mt, while value increased 8% to $4.98 billion.

"Beef exports were really outstanding in July, especially with COVID-related challenges still impacting global foodservice as well as persistent obstacles in shipping and logistics," said USMEF President and CEO Dan Halstrom. "Retail demand continues to be tremendous, as evidenced by the new beef value record. On the pork side, the U.S. industry remained focused on market diversity even when China's import volumes were absolutely off the charts. That philosophy is paying strong dividends now, with exports maintaining a record pace even as muscle cut exports to China trend significantly lower."

Halstrom was especially pleased to see pork variety meat exports bolster the July results, climbing back from a labor-related slump in mid-2020.

"While the tight labor situation is still very much a challenge for exporters, the variety meat capture rate has certainly improved and it is great to see exports exceed pre-COVID levels," he said. "This is especially important because China's demand for pork variety meat remains strong and it is critical that the U.S. industry capitalizes on this opportunity."

Asia underpins record beef export value; volumes rebound in Western Hemisphere

July beef exports to the mainstay Asian markets of Japan, South Korea and Taiwan were relatively steady with last year, but at significantly higher value. Japan was the pacesetter in both volume (28,549 mt, steady) and value ($225.3 million, up 21%) as retail demand offset ongoing restrictions in the restaurant sector. Through July, Japan was the leading volume destination for U.S. beef (184,836 mt, up 1% from a year ago) and a close second to Korea in value ($1.27 billion, up 9%).

Despite volume falling 4% from a year ago to 23,369 mt, July exports to Korea still posted a 23% increase in value ($207.2 million, second highest on record). Through July, exports to Korea are on a record pace at 165,669 mt, up 17% from a year ago, with value up 29% to $1.29 billion.

Taiwan was one of only a few global markets that did not impose foodservice restrictions in 2020, but suspended most dine-in restaurant service in mid-May of this year. The ban was lifted in late July but with significant restrictions still in place, so demand for U.S. beef continues to shift toward the retail sector. Similar to Korea, July exports to Taiwan fell 3% from a year ago to 5,815 mt, but value still soared 28% to $61.8 million. Through July, export volume was steady with last year at 35,176 mt, while value increased 14% to $341.4 million.

Beef exports to China continued to post impressive growth, with July shipments reaching a record 18,021 mt, valued at $150.5 million. Through July, exports to China were up about 1,000% from a year ago in both volume (99,022 mt) and value ($773 million). U.S. beef accounted for 5% of China’s total imports, and the U.S. is now the primary supplier of grain-fed beef to China. Although beef exports to Hong Kong have trended lower in 2021, shipments to the China/Hong Kong region more than doubled from a year ago to 128,748 mt (up 137%) valued at $1.05 billion (up 139%).

Other January-July highlights for U.S. beef exports include:

- July beef exports to Mexico increased 17% from a year ago to 15,568, with value nearly doubling to $93 million (up 90%). Through July, compared to last year's relatively low totals, exports to Mexico posted a 15% increase in volume (115,189 mt) and jumped 30% in value to $574.3 million.

- Beef exports to Central America were also down in 2020 but have staged an impressive comeback this year. January-July exports set a record pace, climbing 53% to 11,086 mt while value soared 74% to $66.3 million. Exports nearly doubled from a year ago to Costa Rica and were sharply higher to Guatemala, Panama, Honduras and El Salvador.

- Led by a strong rebound in Colombia and solid growth in Chile and Peru, beef exports to South America increased 24% from a year ago to 16,663 mt, valued at $84.1 million (up 57%).

- July beef export value equated to $425.68 per head of fed slaughter, up 52% from a year ago. Through July, export value was $369.15 per head, up 24%. Exports accounted for 15.4% of total July beef production and 13.2% for muscle cuts, up significantly from the July 2020 ratios of 12.9% and 10.8%, respectively. Through July, exports accounted for 14.8% of total production (up from 13.2%) and 12.6% for muscle cuts (up from 10.9%).

Mexico, CAFTA region, Philippines keep pork exports on record pace

While July pork exports to Mexico pulled back from the very large totals posted in May and June, volume still increased 18% from a year ago to 66,442 mt while value soared 81% to $146.5 million. Through July, exports to Mexico were up 22% from a year ago to 462,771 mt, with value up 50% to $936 million. Compared to 2017, the record year for export volume to Mexico, January-July exports were 1% higher in volume and 10% higher in value.

Pork exports to Japan trended higher in July (31,344 mt, up 7%), with value up 8% to $138.3 million. This pushed January-July results 7% ahead of last year's pace at 239,043 mt, valued at just over $1 billion (up 6%). Japan’s imports of U.S. chilled pork gained momentum in recent months and were up 6% from a year ago, totaling 124,566 mt through July.

Following a record performance in 2020, pork exports to Central America continue to achieve broad-based growth. July exports totaled 9,196 mt, one-third higher than a year ago, while value increased 64% to $26.8 million. January-July exports were higher to all markets in the region, led by a doubling of exports to El Salvador and very strong increases in Honduras, Guatemala and Costa Rica. Through July, exports were up 47% from a year ago to 76,991 mt, valued at $203.5 million (up 58%).

U.S. pork continues to capitalize on temporary tariff relief in the Philippines, where July exports increased 24% to 5,765 mt, valued at $14.2 million (up 16%). Through July, exports to the Philippines roughly tripled last year's totals in both volume (63,775 mt, up 193%) and value ($166.2 million, up 206%).

Other January-July highlights for U.S. pork exports include:

- Following a difficult year in 2020, pork exports to Colombia continue to trend higher. Though still below the pre-COVID totals of 2019, January-July exports to Colombia increased 50% from a year ago to 54,220 mt, with value up 60% to $126.9 million.

- Pork exports to South Korea reached $50.2 million in July, up 80% from a year ago, while volume increased 34% to 13,653 mt. Fueled in part by strong retail demand for chilled pork, January-July exports to Korea increased 6% from a year ago to 109,807 mt, with value up 19% to $351.7 million. Korea’s imports of U.S. chilled pork totaled 5,377 mt through July, up 176% from a year ago, with the U.S. capturing 37% of Korea’s chilled import market – up from 19% last year.

- Demand for U.S. pork continues to soar in the Dominican Republic, where January-July exports climbed 39% from a year ago to 33,382 mt, valued at $83.2 million (up 54%). Exports could further strengthen due to the recent finding of African swine fever in the Dominican Republic, which resulted in significant culling in an effort to contain the disease.

- China/Hong Kong remained the largest destination for U.S. pork through July, despite a 22% decline to 525,058 mt. Export value fell 21% to $1.23 billion. While China slipped to the number two destination (behind Mexico) for U.S. pork muscle cuts in the second half of last year, its demand for U.S. pork variety meat remains outstanding. In July, pork variety meat exports to China were the second largest on record and the combined total for China/Hong Kong was fourth highest. Through July, variety meat exports to the region climbed 22% from a year ago to 201,849 mt, valued at $491 million (up 29%).

- July pork export value equated to $67.13 per head slaughtered, up 37% from a year ago. Through July, per-head export value averaged $67.05, up 9%. Exports accounted for 30% of total July pork production and 25.2% for muscle cuts, up from 26% and 24%, respectively, in July 2020. Through July, exports accounted for 31.2% of total production (up from 30.7% in 2020) and 27.9% for muscle cuts (up slightly).

Lamb exports slow in July, but still higher year-to-date

Lower demand in leading market Mexico pushed July lamb exports 27% below last year in volume (1,166 mt) and 7% lower in value ($1.7 million). Through July, exports were still 13% above last year's pace at 7,982 mt, with value up 10% to $10.8 million.

Complete January-July export results for U.S. pork, beef and lamb are available from USMEF's statistics web page.

For questions, please contact Joe Schuele or call 303-547-0030.

NOTES:

- Export statistics refer to both muscle cuts and variety meat, unless otherwise noted.

- One metric ton (mt) = 2,204.622 pounds.

- U.S. pork currently faces retaliatory duties in China. China's duty rate on frozen pork muscle cuts and variety meat increased from 12% to 37% in April 2018, from 37% to 62% in July 2018 and from 62% to 72% on Sept. 1, 2019. The rate on pork cuts was reduced to 68% on Jan. 1, 2020, through a reduction in the most-favored-nation (MFN) rate and to 63% on Feb. 14, 2020, through a reduction in the Section 301 retaliatory duty. The duty on pork variety meat was reduced to 67% on Feb. 14.

- U.S. beef faces retaliatory duties in China. China's duty rate on beef muscle cuts and variety meats increased from 12% to 37% in July 2018 and from 37% to 47% on Sept. 1, 2019. It was reduced to 42% on Feb. 14, 2020.

- In February 2020, China announced a duty exclusion process that allows importers to apply for relief from duties imposed in response to U.S. Section 301 duties. When an application is successful, the rate for U.S. beef can decline to the MFN rate of 12% and the rate for U.S. pork can decline to 33% for muscle cuts and 37% for pork offal (the 25% Section 232 retaliatory duty on U.S. pork remains). Some importers reported receiving duty relief beginning on March 2, 2020.

- Mexico's duty rate on pork muscle cuts increased from zero to 10% in June 2018 and jumped to 20% the following month. Beginning in June 2018, Mexico also imposed a 15% duty on sausages and a 20% duty on some prepared hams. Mexico removed all duties in late May 2019.