Broad-Based Growth Drives U.S. Beef and Pork Exports to New Heights

Fueled by impressive growth in a wide range of destinations, U.S. beef and pork export value shattered previous records in May, according to data released by USDA and compiled by USMEF. Beef exports also reached a new volume high in May, while pork export volume was the third largest on record.

"The outstanding May performance is especially gratifying when you consider where red meat exports stood a year ago," noted USMEF President and CEO Dan Halstrom. "The industry faced unprecedented, COVID-related obstacles at all levels of the supply chain, and a very uncertain international business climate. These challenges are still not behind us, but international demand has been very resilient and the U.S. industry has shown a tremendous commitment to serving its global customers."

Halstrom cautioned that U.S. labor availability remains a major concern and limitation for the industry, and exporters continue to face significant obstacles when shipping product overseas. Due to the ongoing, fluid impact of COVID-19, foodservice restrictions also continue to affect several key markets where dine-in service is either suspended or subject to capacity limits and shorter hours, and tourism has not yet returned in many countries.

"USMEF remains optimistic that international demand will remain strong in the second half of 2021, but the road ahead is not an easy one," Halstrom said. "The U.S. industry must continue to be innovative and aggressive in defending existing market share, while also expanding our customer base by responding to COVID-driven changes in the marketplace and shifts in consumer trends and preferences."

While May beef exports were expected to far exceed last year's low totals, export volume soared to a record 133,440 metric tons (mt), up 68% from a year ago, and value increased 88% to $904.3 million. This was the third consecutive monthly value record for beef exports, which had never exceeded $800 million before March 2021. For January through May, exports reached 587,838 mt, up 15% from a year ago, while value increased 22% to $3.84 billion.

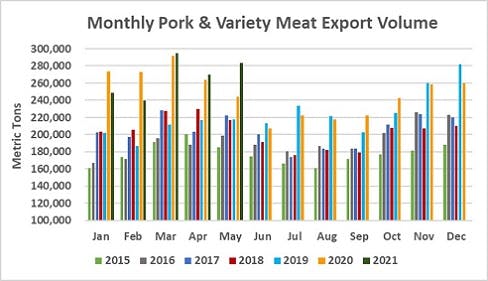

May pork exports totaled 283,617 mt, up 16% from a year ago and the third largest on record (trailing only March 2021 and March 2020). Export value exceeded $800 million for the first time in May, climbing 31% to $813.2 million. For January through May, pork exports were slightly below last year's record pace at 1.34 million mt (down 1%), but export value increased 3% to $3.63 billion.

Record month for beef exports to Korea; strong rebound in Japan and Taiwan

Beef export value equated to $433.18 per head of fed slaughter in May, up 53% from a year ago and breaking the previous record by more than $65. The January-May average was $361.29 per head, up 13%. Exports accounted for 17.6% of total May beef production and 14.9% for muscle cuts only, up dramatically from the year-ago ratios of 12.5% and 10.5%. January-May exports accounted for 15% of total production and 12.6% for muscle cuts, each about one full percentage point higher than a year ago.

Beef exports to South Korea were record-large in May at 29,403 mt, up 61% from a year ago, valued at $225.4 million (up 87%). This pushed January-May exports 20% above last year's pace at 121,881 mt, with value up 27% to $912 million. Driven by excellent retail demand in both traditional venues and e-commerce, Korea is the leading value market for U.S. beef in 2021. Despite some COVID-related restrictions, Korea's foodservice sector has also been a strong performer for U.S. beef. Through May, U.S. beef captured 66% of Korea’s chilled beef import market, up one percentage point from last year. Chilled volume was nearly 33,000 mt, up 21% from a year ago.

May exports to Japan, the top volume destination for U.S. beef, rebounded to 30,721 (up 54% from a year ago) valued at $208.3 million (up 71%). Exports were impacted in April by a higher safeguard tariff rate, which Japan imposed for 30 days. But in mid-April the safeguard rate expired and U.S. beef received its annual tariff reduction under the U.S.-Japan Trade Agreement, putting U.S. product back on a level playing field with major competitors, with beef muscle cuts tariffed at 25%. Through May, beef exports to Japan were still 2% below last year at 131,423 mt, but export value was up 3% to $864.2 million.

Beef exports to China totaled 16,472 mt in May, only slightly trailing the April record, valued at $130.2 million. With expanded beef access to China in place for more than one year under the Phase One Economic and Trade Agreement, exports to the world's largest beef import market continue to climb. January-May exports to China reached 64,763 mt valued at $474.7 million – each up about 1,200% year-over-year and already establishing new annual records. The United States is now the largest supplier of grain-fed beef to China and accounted for 4.4% of China’s total beef imports in the first five months of the year.

Other January-May highlights for U.S. beef exports include:

- Down by double digits in the first quarter, May exports of beef variety meat trended higher year-over-year for the second consecutive month at 28,347 mt (up 65% and the largest since 2019). May export value was $91.3 million, up 72% and the third highest on record. While the variety meat capture rate continues to be challenged by labor availability at the plant level, demand is strong in Latin America and Southeast Asia, with beef tongue and other variety meat exports to Japan also trending higher and a rebound in liver exports to Egypt. Through May, beef variety meat exports were 6% ahead of last year's pace at 125,175 mt, valued at $396.8 million (up 7%).

- After a slow start in 2021, beef exports to Taiwan continue to show improvement. May exports were the largest of the year at 5,648 mt (up 41% year-over-year), valued at $52.2 million (up 60%). Through May, exports to Taiwan remained 6% below last year at 23,502 mt, but export value increased 3% to $222 million.

- Led by strong growth in Guatemala and Honduras and a near-doubling of shipments to El Salvador, beef exports to Central America increased 48% from a year ago to 8,401 mt, valued at $50.6 million (up 60%).

- Beef exports to South America have made a strong comeback in 2021, led by growth in Chile and Colombia. Through May, exports to the region increased 24% from a year ago to 12,422 mt, valued at $63.3 million (up 52%).

Strong demand from wide range of markets offsets lower pork exports to China

Pork export value per head slaughtered averaged $77.64 in May, up 7% from a year ago. Through May, the per-head average was $66.16 (down 2%). Exports accounted for 38.1% of total May pork production, up nearly 2 percentage points from a year ago, while the share of muscle cuts exported was 33.8% (up from 33.3%). January-May exports accounted for 31.8% of total pork production and 28.6% of muscle cuts, compared to 33% and 30%, respectively, for the same period in 2020 but sharply higher than the 2019 ratios of 25% and 22%.

May pork exports to Mexico were the largest of 2021 at 71,370 mt, up 89% from a year ago, valued at $151.6 million (up 158%). With tight domestic supplies in Mexico and a rebound in demand from Mexico's processing and foodservice sectors complementing strong retail sales, January-May exports to Mexico reached 325,747 mt, up 18% from a year ago, with value up 35% to $640.1 million. Mexico has recaptured its position as the top volume destination for U.S. pork muscle cuts, with exports through May totaling 275,825 mt, up 20% year-over-year.

After slowing in April, pork exports to Japan rebounded to 36,504 mt (up 34% from a year ago), valued at $154.7 million (up 39%). Through May, exports to Japan increased 3% year-over-year in both volume (174,280 mt) and value ($726.6 million).

U.S. pork continues to achieve outstanding growth in Central America, where May exports reached 10,866 mt (up 57% from a year ago) and nearly doubled in value to $29.7 million (up 92%). May exports to top market Honduras were the second highest on record (after March 2021) at 4,704 mt. Through May, exports to the Central American region exceeded last year's record pace by 51% in volume (57,723 mt) and 56% in value ($149.1 million).

Bolstered by a temporary drop in tariff rates and strong retail demand, pork exports to the Philippines remained large in May at 10,443 mt (up 353% from a year ago), with value up 370% to $28.7 million. For January through May, exports to the Philippines nearly quadrupled year-over-year in both volume (50,116 mt, up 274%) and value ($128.2 million, up 289%).

Other January-May highlights for U.S. pork exports include:

- Following a down year in 2020, pork exports to Colombia continue to post an impressive rebound despite persistent challenges related to COVID-19. May exports increased 151% from a year ago to 8,290 mt, with value nearly tripling to $20 million (up 190%). Through May, exports to Colombia increased 43% from a year ago to 41,052 mt, valued at $93.9 million (up 46%).

- Pork exports to the Dominican Republic are on a record pace in 2021. May exports were up 5% from a year ago to 3,763 mt, while value jumped 31% to $10.1 million. Through May, exports were 40% above last year in volume (25,861 mt) and 49% higher in value ($62.3 million).

- Led by larger shipments of chilled pork and continued strong demand for convenience-based products, pork exports to Korea reached 17,966 mt in May, up 10% from a year ago, while value increased 38% to $60 million. January-May exports still trailed last year by 2% at 81,203 mt, but value increased 4% to $248.1 million.

- Though demand has softened from the enormous totals posted a year ago, China/Hong Kong is still the largest destination for U.S. pork in 2021. This is partly due to sustained demand for variety meat, for which exports through May were up 3% to 136,577 mt, with value up 9% to $332 million. But a slowdown in muscle cuts meant total exports were down 22% to 408,896 mt, valued at $952.7 million (down 24%). The continued decline in China's pork and live hog prices suggests this trend is likely to accelerate in coming months, underscoring the importance of further export growth to other destinations.

May lamb exports largest of 2021

Led by larger shipments to Mexico and the Caribbean, May exports of U.S. lamb were the highest of the year at 1,377 mt (up 43% from a year ago), valued at $1.82 million (up 67%). Through May, exports were 53% above last year's pace at 5,733 mt, with value increasing 16% to $7.43 million. While variety meat demand from Mexico accounted for most of the export volume growth for U.S. lamb, muscle cut shipments also increased to Mexico, Canada, Bermuda and Trinidad and Tobago.

Complete January-May export results for U.S. pork, beef and lamb are available from USMEF's statistics web page.

For questions, please contact Joe Schuele or call 303-547-0030.

NOTES:

- Export statistics refer to both muscle cuts and variety meat, unless otherwise noted.

- One metric ton (mt) = 2,204.622 pounds.

- U.S. pork currently faces retaliatory duties in China. China's duty rate on frozen pork muscle cuts and variety meat increased from 12% to 37% in April 2018, from 37% to 62% in July 2018 and from 62% to 72% on Sept. 1, 2019. The rate on pork cuts was reduced to 68% on Jan. 1, 2020, through a reduction in the most-favored-nation (MFN) rate and to 63% on Feb. 14, 2020, through a reduction in the Section 301 retaliatory duty. The duty on pork variety meat was reduced to 67% on Feb. 14.

- U.S. beef faces retaliatory duties in China. China's duty rate on beef muscle cuts and variety meats increased from 12% to 37% in July 2018 and from 37% to 47% on Sept. 1, 2019. It was reduced to 42% on Feb. 14, 2020.

- In February 2020, China announced a duty exclusion process that allows importers to apply for relief from duties imposed in response to U.S. Section 301 duties. When an application is successful, the rate for U.S. beef can decline to the MFN rate of 12% and the rate for U.S. pork can decline to 33% for muscle cuts and 37% for pork offal (the 25% Section 232 retaliatory duty on U.S. pork remains). Some importers reported receiving duty relief beginning on March 2, 2020.

- Mexico's duty rate on pork muscle cuts increased from zero to 10% in June 2018 and jumped to 20% the following month. Beginning in June 2018, Mexico also imposed a 15% duty on sausages and a 20% duty on some prepared hams. Mexico removed all duties in late May 2019.