August Pork Exports Trend Higher; Beef Exports Again Top $1 Billion

Slides of January-August export highlights

August exports of U.S. pork topped year-ago totals for the first time in 2022, according to data released by USDA and compiled by the U.S. Meat Export Federation (USMEF). Beef exports were slightly above last August’s large volume and again topped $1 billion in value, reaching this milestone in seven out of eight months this year.

Pork exports reached 226,293 metric tons (mt) in August, up slightly from a year ago and the largest since November 2021, while export value climbed 4% to $659.6 million. Through August, pork exports were 15% below last year at 1.72 million mt, valued at $4.9 billion (down 13%).

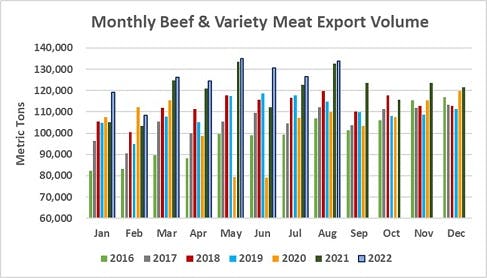

August beef exports totaled 133,832 mt, up 1% year-over-year and the second largest volume on record – trailing only May 2022. Export value was just under $1.04 billion, slightly below the then-record total achieved in August 2021, which was the first time monthly exports topped the $1 billion mark. For the first eight months of 2022, beef exports increased 5% from a year ago to 1.004 million mt, valued at $8.23 billion – a remarkable 24% above last year’s record pace.

"We speak often about the importance of developing a wide range of markets for U.S. red meat, and the August export results are a great illustration of that,” said USMEF President and CEO Dan Halstrom. "Exports face significant headwinds in some key destinations, with weakened currencies topping the list. But the emphasis on broad-based growth really pays dividends in these situations, allowing the overall export picture to remain very positive. I also cannot say enough about the loyalty of our international customers, many of whom have diminished purchasing power but continue to show a strong preference for U.S. red meat.”

Pork exports led by growth in Mexico, Korea, strong variety meat demand

August pork exports were once again led by Mexico, where 2022 shipments remain on a record pace. While August export volume (81,178 mt) was up only slightly from a year ago, export value increased 20% to $195 million. This pushed January-August exports to Mexico to 620,718 mt, up 14% from a year ago, while value increased 13% to $1.25 billion. Unlike many trading partner currencies, the Mexican peso has been remarkably stable, averaging just over 20 pesos to the dollar this year, remaining essentially steady with 2021.

Fueled by strengthening demand for pork variety meat, pork exports to China/Hong Kong totaled 55,695 mt in August, up 14% from a year ago, while export value climbed 31% to $137.8 million. Most of the volume increase was in the variety meat category, for which exports were record large (34,831 mt, up 18%). But muscle cut exports were also 7% above last year at 20,864 mt, the highest since June 2021. For January through August, total exports to China/Hong Kong remained 44% below last year at 323,422 mt, with value down 37% to $850.1 million.

South Korea recently opened a duty-free quota on imported pork – a move that mainly benefited Canadian, Mexican and Brazilian pork, because imports from the U.S., the European Union and Chile already enter Korea at zero duty. While August volume was the smallest in six months, U.S. exports to Korea were still sharply higher than the small year-ago total, climbing 37% to 13,568 mt. Export value reached $48.6 million, up 34%. For the first eight months of 2022, pork exports to Korea were 1% above last year at 120,687 mt, while value was up 9% to $424.1 million.

Other January-August results for U.S. pork exports include:

Fueled by record exports to China/Hong Kong (see above), global exports of U.S. pork variety meat were the third largest on record in August at 52,958 mt, up 14% from a year ago. Export value was the second largest on record at $118.3 million, up 12%. In addition to China/Hong Kong, August exports increased year-over-year to the Philippines, Vietnam, Canada, Colombia, the Dominican Republic, Japan, Korea, Guatemala, Honduras and Taiwan.

August pork exports to the Philippines rebounded to 5,712 mt, up 44% from a year ago and the largest in 13 months. Export value climbed to $18.1 million, up 66%. August exports to Vietnam and Singapore were also higher year-over-year, pushing shipments to the ASEAN region to 6,489 mt (up 49% from a year ago), valued at $20.5 million (up 66%). For January through August, exports to the region were still 53% below last year at 35,432 mt, valued at $102.6 million (down 49%).

Although August exports to Colombia were slightly below last year in both volume and value, year-to-date exports remain on a record pace. Through August, shipments to Colombia increased 10% to 69,502 mt, while value was up 9% to $163 million.

Led by strong demand in the Dominican Republic, pork exports to the Caribbean also remained on a record pace through August at 64,294 mt, up 33% from a year ago, valued at $175.6 million (up 36%). While the DR accounted for most of this growth, exports are also on a record pace to the Bahamas, the Leeward-Windward Islands, Bermuda and Turks and Caicos. Shipments also trended higher to most other markets, including Barbados, Cayman Islands, Haiti and the Netherlands Antilles.

Pork exports to Japan continued to trend lower in August at just under 27,000 mt, down 18% from a year ago, valued at $107.4 million (down 25%). Through August, exports to Japan were 10% below last year’s pace at $245.3 million, valued at $1.02 billion (down 11%). With the historic devaluation of the yen, Japan has been importing dramatically more pork from the European Union, Mexico and Brazil.

August pork export value equated to $60.04 per head slaughtered, up slightly from a year ago. The January-August average was $59.40 per head, down 9%. Exports accounted for 27.3% of total August pork production and 22.5% for muscle cuts, down from 28.3% and 24.3%, respectively, a year ago. The January-August ratios were 26.9% and 23.5%, down from 30.4% and 26.8% in the first eight months of 2021.

Widespread growth, led by China/Hong Kong, Middle East and ASEAN, bolster August beef exports

Despite China’s ongoing travel restrictions and periodic lockdowns in some of its largest metropolitan areas, demand for U.S. beef continues to grow. August exports to China/Hong Kong reached a record 30,806 mt, up 20% from a year ago, while value increased 17% to $272.3 million. Through August, exports increased 25% to 193,511 mt, while value was up 38% to $1.77 billion. China/Hong Kong is the second highest value destination for U.S. beef in 2022, trailing only South Korea, and China was the top value destination for U.S. beef muscle cut exports in August. Though not reflected in the January-August results, Hong Kong’s foodservice and hospitality sectors recently received a boost as health officials lifted onerous hotel quarantine requirements for incoming travelers.

August beef exports to Korea were slightly above last year’s large volume at 24,546 mt, though export value slipped 2% to $213.1 million. Through August, exports to Korea were 4% above last year’s record pace at 197,749 mt, with value climbing 28% to $1.93 billion. Similar to pork, Korea recently opened a duty-free quota for imported beef. Although the quota temporarily eliminated U.S. beef’s tariff rate advantage over major competitors and helped underpin a sharp increase in imports from Australia and Canada, the move has bolstered overall beef demand amid rising inflation and sharp devaluation of the Korean won.

Following a strong July performance, beef exports to Japan took a step back in August at 25,959 mt, down 18% from a year ago. Export value was $189.3 million, down 19%. This included a sharp decline in beef variety meat exports (mainly tongues and skirts), which fell 46% to 3,964 mt. Through August, Japan remained the leading volume destination for U.S. beef exports at 212,198 mt, down 2% from a year ago, while export value increased 11% to $1.67 billion. Japan is the leading value destination for U.S. beef variety meat exports, and while January-August exports were down 8% in volume (37,545 mt), export value climbed 28% above last year’s record pace at $379.4 million.

Other January-August results for U.S. beef exports include:

August beef exports to Taiwan rebounded from a down month in July but were still 7% lower than a year ago in both volume (6,008 mt) and value ($65.8 million). Through August, exports to Taiwan remain on a record pace in 2022, climbing 15% to 47,865 mt, valued at $561.5 million (up 36%).

Led by growth in Egypt and the United Arab Emirates, August beef exports to the Middle East reached 5,691 mt, up 85% from a year ago, while export value more than doubled to $28.3 million (up 114%). For beef muscle cuts, August exports were the second highest since 2013 (after May of this year) at 2,098 mt, up 114%, while value increased 132% to $219 million. Fueled by a rebound in the foodservice and hospitality sectors, January-August exports to the region increased 15% from a year ago to 46,280 mt, valued at $210.9 million (up 64%).

Beef exports to Canada posted a strong August performance at 9,440 mt, up 10% from a year ago, while export value climbed 16% to $77.1 million. Through August, exports to Canada were 2% above last year at 70,160 mt, while value increased 16% to $574.2 million. Tourism in Canada is likely to get a boost from removal of COVID vaccination and testing requirements for incoming travelers, which were dropped on Oct. 1.

In the ASEAN region, beef exports are on a record pace to the Philippines, Singapore, Thailand and Cambodia and year-over-year growth is robust to Vietnam. January-August exports were 8% higher than a year ago at 43,472 mt, while value soared 57% to $318 million. Export value to the Philippines more than doubled to $113.3 million (up 112%), while Vietnam climbed 72% to $56.7 million. Exports to the Philippines set a new record in August, nearly tripling last year’s totals in both volume (2,744 mt, up 196%) and value ($16.8 million, up 177%).

Beef exports to Colombia continued to climb in August, increasing 45% in volume (784 mt) and 13% in value ($3.3 million). Through August, exports to Colombia are on a record pace at 6,690 mt, up 51%, while value increased 64% to $32.2 million.

August beef export value equated to $437.98 per head of fed slaughter, down 7% from a year ago, but the January-August average was still up 23% to $471.18. Exports accounted for 15.6% of total August beef production and 13.4% for muscle cuts only, down from 16.4% and 14.2%, respectively, in August 2021. The January-August ratios were 15.5% and 13.3%, each up about one-half percentage point from a year ago.

August exports of lamb muscle cuts trend lower

For the first time in 2022, exports of U.S. lamb muscle cuts were lower than a year ago at 125 mt, down 35%. Export value totaled $827,000, down just 4%. Through August, muscle cut exports increased 65% to 1,407 mt, valued at $8.54 million (up 68%). Led by the Dominican Republic, Netherlands Antilles and Bahamas, exports to the Caribbean more than doubled from a year ago to 720 mt (up 106%) and increased 88% in value to $5.2 million. Exports also increased to Mexico, the ASEAN region and Panama.

As noted last month, USMEF has raised concerns in recent years with USDA about export data collected by the Department of Commerce for lamb variety meat to Mexico. Reported volumes declined dramatically in both July and August to reflect more accurate volumes to Mexico, suggesting that the data reported in prior months and years were disproportionately high. For the time being, USMEF will therefore focus year-over-year comparisons on lamb muscle cuts only.

Complete January-August export results for U.S. pork, beef and lamb are available from USMEF's statistics web page.

For questions, please contact Joe Schuele or call 303-547-0030.

NOTES:

Export statistics refer to both muscle cuts and variety meat, unless otherwise noted.

One metric ton (mt) = 2,204.622 pounds.

U.S. pork and beef currently face retaliatory duties in China. In February 2020, China announced a duty exclusion process that allows importers to apply for relief from duties imposed in response to U.S. Section 301 duties. When an application is successful, the rate for U.S. beef can decline to the MFN rate of 12% and the rate for U.S. pork can decline to 37% (the MFN rate plus the 25% Section 232 retaliatory duty, which remains in place).