Another $1 Billion Month for Beef Exports; Pork Exports Remain Below Year-Ago

U.S. beef exports maintained a remarkable pace in April, topping $1 billion for the third time this year, according to data released by USDA and compiled by the U.S. Meat Export Federation (USMEF). April pork exports were well below the large totals posted a year ago, while lamb exports continued to trend higher.

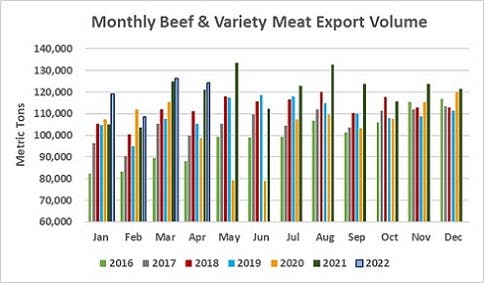

Beef exports totaled 124,408 metric tons (mt) in April, up 3% from a year ago and the fifth largest on record, while export value soared 33% to $1.05 billion – second only to the record $1.07 billion posted in March. For January through April, beef exports increased 5% from a year ago to 478,260 mt, valued at $4.05 billion (up 38%).

"Global demand for U.S. beef continues to overcome enormous obstacles, from inflationary pressure to logistical challenges to the recent lockdowns in some of China’s major metropolitan areas,” said USMEF President and CEO Dan Halstrom. "Most encouraging is that even as beef exports climb to unprecedented levels in our largest Asian markets, demand is strengthening in other regions as well, fueled by a strong rebound in the foodservice sector."

Halstrom cautioned that April results did not capture the full impact of recent COVID-19 lockdowns in China, some of which continued through May and into early June. The pressure inflation imposes on consumers’ discretionary income and the rising strength of the U.S. dollar versus some key trading partner currencies are also growing headwinds for U.S. red meat exports.

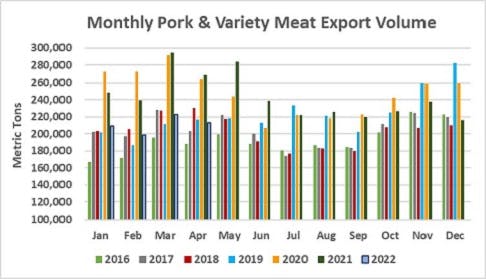

April pork exports were 212,876 mt, down 21% from the large volume reported a year ago. Export value was $600.6 million, down 20%. Through April, pork exports fell 20% from a year ago to 842,804 mt, valued at $2.31 billion (down 18%).

"The sharp decline in China’s demand for imported pork continues to weigh heavily on the year-over-year results for U.S. exports, and the COVID lockdowns dampened demand even further by limiting consumer spending and slowing activity in the wholesale market and the meat processing sector,” Halstrom explained. "We do expect exports to China to regain some momentum in the fourth quarter of this year – certainly not back to the peak volumes of 2020, but improving over current levels. Meanwhile shipments to Mexico remain on a record pace and exports to Japan and several Latin American markets trended higher in April."

Record exports to Taiwan highlight huge month for beef exports

April beef exports to Taiwan reached new heights at 7,466 mt, up 41% from a year ago, while value climbed 36% to $87.1 million. Through April, exports to Taiwan increased 45% from a year ago to 25,889 mt, while value soared 85% to $314.3 million. In just four months, export value for Taiwan was already nearly halfway to last year’s annual value record of $668 million.

Beef exports to Japan trended higher in April, increasing 5% from a year ago to 26,663 mt, while value climbed 29% to $220.6 million. This pushed January-April exports to 98,842 mt, down 2% from a year ago but still slightly ahead of South Korea as the largest volume destination for U.S. beef. Export value to Japan increased 24% to $814.8 million. This included a 47% jump in beef variety meat export value – consisting mostly of tongues and skirts – which reached $191.2 million.

April exports to Korea, the leading value market for U.S. beef, were down slightly from last year at 23,212 mt, but export value still increased 26% to $231 million. January-April export value already topped $1 billion ($1.02 billion, up 49%), a record pace for any single destination. Export volume is also ahead of last year’s record pace, increasing 7% to 98,657 mt.

Other January-April results for U.S. beef exports include:

- Beef demand in China/Hong Kong continues to expand, though at a more moderate rate than in 2021. Despite COVID lockdowns having a massive effect on China’s foodservice sector, April exports still increased 11% from a year ago to 23,137 mt, valued at $212.7 million (up 27%). Through April, exports to China/Hong Kong increased 28% in volume (85,374 mt) and 49% in value ($795.1 million).

- Beef exports to the ASEAN region have strengthened in 2022 and momentum accelerated in April, with a new record volume to the Philippines (2,718 mt) and the sixth highest month on record for Indonesia (3,083 mt). Through April, exports to Indonesia increased 6% to 7,830 mt, while value soared 78% to $47.8 million. Exports to the Philippines followed a similar trend, edging 1% higher in volume (6,010 mt) but climbing 69% in value ($45.9 million). With demand also increasing in Vietnam, region-wide exports increased 8% to 19,373 mt, valued at $143.7 million (up 66%).

- Fueled by variety meat demand in Egypt and larger muscle cut shipments to Kuwait, Qatar and Israel, beef exports to the Middle East continue to rebound. Through April, exports to the region increased 11% to 23,536 mt, valued at $101 million (up 41%). The foodservice sector in several Gulf Region markets has regained momentum in recent months, buoyed by increased tourism and rising oil industry revenues.

- A foodservice rebound is also underway in the Caribbean, where January-April beef exports increased 42% to 8,945 mt and value more than doubled to $80.1 million (up 106%). Growth was led by record volumes to the Dominican Republic and Cayman Islands, while shipments rebounded to other main markets including Jamaica and the Bahamas.

- April beef export value equated to $489.59 per head of fed slaughter, up 33% from a year ago and the second highest on record. The January-April average was $478.03 per head, up 39%. Exports accounted for 15.6% of total April beef production, up from 15% last year and the highest ratio since September 2021. The ratio for muscle cuts was 13.6%, up one full percentage point from a year ago. January-April exports accounted for 15% of total production and 12.8% for muscle cuts, up from 14.4% and 12.1%, respectively.

Pork exports regain momentum in Japan, set new record to Dominican Republic

Mexico’s demand for U.S. pork continues to build on last year’s record performance. April exports reached 73,711 mt, up 9% from a year ago, though value slipped 2% to $139.7 million. Through April, exports to Mexico climbed 25% to 317,085 mt, valued at $543.9 million (up 11%). Mexico recently suspended import duties on pork muscle cuts, which could attract more product from the European Union. The EU currently holds about 2% market share in Mexico, though a substantial percentage of its exports are processed products and variety meat, which are still subject to normal duties. Canadian and Chilean pork already enter Mexico duty-free under existing trade agreements, and Brazilian pork is not eligible for export to Mexico.

After slowing in March, pork exports to Japan regained momentum in April. Export volume reached 34,682 mt, up 5% from a year ago and the largest since May 2021. Export value also increased 5%, reaching a 2022 high of $142.5 million. Through April, exports to Japan were still 9% below last year at 126,006 mt, valued at $535.1 million (down 6%). But despite major logistical challenges, Japan’s January-April imports of U.S. chilled pork increased 2% to 73,052 mt. Imports from Canada, the primary competitor in Japan’s chilled pork market, declined 3% to just over 68,000 mt.

Pork exports to the Dominican Republic were already gaining strength before African swine fever (ASF) was confirmed in July 2021, and ASF’s impact on domestic production has accelerated this trend. April exports reached a record 8,966 mt, up 94% from a year ago and smashing the previous (March 2022) record by 27%. April export value was a record $21.8 million, up 88% from a year ago. Through April, exports to the DR increased 25% to 27,592 mt, with value climbing 29% to $67.4 million. With shipments also trending higher to the Bahamas, exports to the Caribbean increased 21% in volume (32,933 mt) and 27% in value ($86 million).

Other January-April results for U.S. pork exports include:

- Pork export value to South Korea has trended higher in 2022, driven in part by strong retail demand for convenience-based items and chilled pork cuts. While April exports trended lower, January-April value was still up 9% from a year ago to $206.9 million. Export volume to Korea fell 7% through April to 58,986 mt, but Korea’s imports of chilled U.S. pork were up 26% in volume (3,523 mt) and climbed 54% in value to $24.8 million. Competition in this market will further intensify when the Korean government implements a duty-free tariff rate quota (TRQ) later this month. With imports from the U.S., European Union and Chile already entering at zero duty under free trade agreements, the main beneficiaries of the TRQ are expected to be Canadian, Mexican and Brazilian pork. Canada is already a major chilled pork supplier, and currently pays an 8.6% duty. Mexico and Brazil have a relatively small presence in the Korean pork market and are subject to duties on 22.5% on chilled pork and 25% on frozen. Although Korea’s domestic pork production is expected to be record-large this year, hog prices are at a record high of about $2.65 per pound.

- Pork demand in Honduras strengthened in both March and April, pushing January-April exports close to last year’s record pace. Exports totaled 16,325 mt, down 1% from a year ago, while value fell 2% to $34.1 million. Central America’s demand for U.S. pork remains relatively strong but exports trail last year's record pace by 12% in volume (41,254 mt) and 8% in value ($109.6 million).

- Pork exports to Colombia started the year slowly but increased sharply in April, reaching 9,827 mt (up 39% from a year ago), valued at $21.9 million (up 34%). Through April, exports were still 5% below last year’s record pace in both volume (30,893 mt) and value ($70.3 million).

- As anticipated, January-April exports to China/Hong Kong dropped significantly from a year ago in both volume (139,732 mt, down 56%) and value ($373.9 million, down 48%). The region is still the dominant destination for U.S. pork variety meat, although demand for these items has also slowed in 2022. Through April, pork variety meat exports to China/Hong Kong were down 19% from a year ago to 83,454 mt, with value falling 3% to $237.2 million. This is due in part to China’s COVID testing and tracing restrictions, which hurt importers’ ability to profitably utilize imported pork variety meat. U.S. pork also remains subject to retaliatory duties in China totaling 50%. Though importers may secure waivers of the 25% duty imposed in response to U.S. Section 301 tariffs, there is no waiver available for the retaliatory duty (also 25%) related to Section 232 tariffs on steel and aluminum.

- April pork export value equated to $59.58 per head slaughtered, down 14% from a year ago. The January-April average was $55.48 per head, down 11%. Exports accounted for 26.9% of total April pork production and 24.3% for muscle cuts. While lower than a year ago (down from 32% and 28.6%, respectively) these were the highest ratios since November. For January through April, exports accounted for 25.8% of total pork production and 23% for muscle cuts, down from 29.5% and 26.5%, respectively, in 2021.

Rebound in Caribbean demand fuels strong April lamb exports

April exports of U.S. lamb increased 37% from a year ago to 1,493 mt, while export value soared 90% to $2.56 million. Growth continues to be driven by large variety meat exports to top market Mexico and revitalized muscle cut demand from the Caribbean foodservice sector.

January-April lamb exports increased 49% from a year ago to 6,512 mt, while value climbed 76% to just under $10 million. Muscle cut exports increased 87% from a year ago to 668 mt, while export value more than doubled to $4.3 million (up 105%).

Complete January-April export results for U.S. pork, beef and lamb are available from USMEF's statistics web page.

For questions, please contact Joe Schuele or call 303-547-0030.

NOTES:

- Export statistics refer to both muscle cuts and variety meat, unless otherwise noted.

- One metric ton (mt) = 2,204.622 pounds.

- U.S. pork and beef currently face retaliatory duties in China. In February 2020, China announced a duty exclusion process that allows importers to apply for relief from duties imposed in response to U.S. Section 301 duties. When an application is successful, the rate for U.S. beef can decline to the MFN rate of 12% and the rate for U.S. pork can decline to 37% (the MFN rate plus the 25% Section 232 retaliatory duty, which remains in place).