September Pork Exports Continue Upward Trend; Pace Cools for Beef

Slides of January-September export highlights

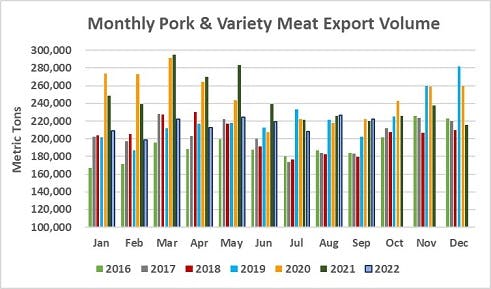

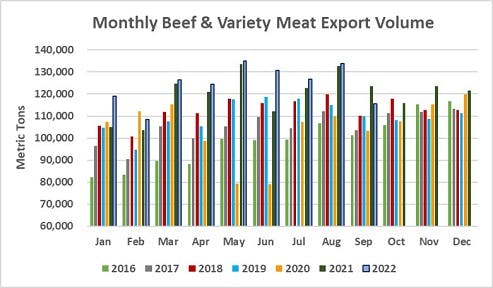

U.S. pork exports topped year-ago totals for the second consecutive month in September, according to data released by USDA and compiled by the U.S. Meat Export Federation (USMEF). September beef exports were below last year for the first time in 2022, but exports remain on a record pace through the first three quarters of the year.

Pork exports reached 222,202 metric tons (mt) in September, up 1% from a year ago. Export value increased 9% to $664.8 million – the highest since June 2021. Through September, pork exports were 13% below last year at 1.94 million mt, valued at $5.57 billion (down 11%).

September beef exports totaled 115,487 mt, valued at $890.3 million, down 7% from a year ago in both volume and value. For the first nine months of 2022, beef exports were still 4% above last year at 1.12 million mt. Export value reached $9.12 billion, up 20% and already achieving the second highest total for any calendar year, trailing only the 2021 record ($10.58 billion).

"It’s very encouraging that U.S. pork exports continue to gain momentum, especially on the value side,” said USMEF President and CEO Dan Halstrom. "Once again we see the importance of market diversification, as the strong September performance was achieved even as the volume shipped to Mexico eased to some degree.”

While beef exports remain well-positioned to reach new heights in 2022, the September results reflected significant headwinds that have been building for some time.

“Demand for U.S. beef has been extremely resilient, but inflationary pressure on consumers and weakened currencies in key markets have definitely created a more challenging environment,” Halstrom said. “Exports also continue to face logistical challenges, lockdowns in China and mounting inventories in some destinations. Still, it’s hard to view September sales of nearly $900 million as a disappointment, when this would have been an all-time record just 18 months ago. That really drives home what a remarkable year this has been for U.S. beef exports.”

Growth in Japan, Korea and Caribbean bolsters September pork exports

September pork exports were once again led by Mexico, though shipments slipped below year-ago volume for the first time since early 2021. September exports totaled 76,084 mt, down 4.5%, but export value still increased an impressive 25% to $176.4 million. Through the first three quarters of the year, exports to Mexico remained on a record pace at 696,802 mt, up 12% from a year ago, while value increased 15% to $1.42 billion. Demand has been bolstered by a very stable Mexican peso, which has held relatively steady with year-ago levels versus the U.S. dollar.

Pork exports to Japan rebounded in September to 31,008 mt, up 7% from a year ago, while value increased 1% to $130 million. These totals were achieved despite historic devaluation of the yen, which has increased the cost of Japan’s imports of all commodities, including food and energy. For January through September, exports to Japan were 8% below last year’s pace at 276,294 mt, while value was down 10% to $1.15 billion.

September pork exports to South Korea climbed 40% above last year’s low volume to 12,284 mt, while value increased 39% to $43.1 million. This pushed January-September totals to 132,971 mt, up 4% from a year ago, while value increased 11% to $467.2 million. Korea recently opened a 70,000 mt, duty-free quota for imported pork, but the competitive landscape has not shifted dramatically because imports from the U.S., the European Union and Chile already enter Korea at zero duty. The move mainly benefited Canadian pork, which is tariffed at 8.6% for chilled and 9.6% for frozen. Mexico and Brazil also have a presence in the Korean pork market, with imports normally subject to Korea’s most favored nation (MFN) rate of 25%, but eligible for duty-free entry within the quota.

Other January-September results for U.S. pork exports include:

Demand for U.S. pork – especially pork variety meat – continues to regain momentum in China/Hong Kong. September exports to the region totaled 51,036 mt, up 12% from a year ago, while export value climbed 18% to $122.5 million. Most of the increase was in variety meats, which reached 33,113 mt – down from the record total achieved in August but still up 17% from a year ago. September muscle cut exports increased 3% to 17,923 mt. For January through September, total exports to China/Hong Kong were 40% below last year at 374,458 mt, with variety meats accounting for 62% of the volume. Value was down 33% to $972.6 million.

Led by record shipments to the Dominican Republic, the Bahamas and the Leeward-Windward Islands, pork exports to the Caribbean are on a record pace through September at 71,147 mt, up 32% from a year ago, valued at $197.8 million (up 36%). Exports to the DR reached 5,609 mt in September, up 34% from a year ago and the largest since June. January-September exports to the DR totaled 58,638 mt, up 38% from a year ago, while value increased 40% to $152.9 million. The DR suspended import duties on red meat and poultry in June, which has heightened competition in the pork market – mainly from Canada, but imports of British, Spanish and Chilean pork have also increased. The decree suspending the DR’s import duties is expected to expire in December, which will subject imports from these suppliers to the MFN rate of 25% and the U.S. will again be the only major pork supplier with duty-free access to the DR.

Pork exports to Colombia are also on a record pace in 2022. September shipments to Colombia increased 9% from a year ago to 8,625 mt, while value was up 10% to $22.6 million. Through September, exports topped last year’s pace by 10% in volume (78,127 mt) and 9% in value ($185.6 million).

September pork exports to the ASEAN region reached 4,380 mt, up 25% from a year ago, while value increased 42% to $12.6 million. The Philippines accounted for most of this growth, but exports also trended higher to Vietnam. For January through September, exports to the region were still 50% below last year at 39,812 mt, valued at $115.2 million (down 45%).

Led by strengthening demand in China/Hong Kong, global exports of U.S. pork variety meat totaled 48,202 mt in September, up 8% from a year ago, while export value increased 5% to $105.9 million. In addition to China/Hong Kong, September exports increased year-over-year to the Philippines, Canada, Colombia, the Dominican Republic, Korea, Guatemala, Honduras and El Salvador. Through September, pork variety meat exports trailed last year by 9% in volume (370,961 mt) and 5% in value ($904.9 million).

September pork export value equated to $62.37 per head slaughtered, up 10% from a year ago. The January-September average was $59.74 per head, down 7%. Exports accounted for 27.3% of total September pork production, up from 26.9% a year ago, while the ratio for muscle cuts was steady with last year at 23.1%. The January-September ratios were 26.9% and 23.4%, down from 30% and 26.4%, respectively, in the first nine months of 2021.

While headwinds impact beef exports, annual records still within reach

Despite China’s zero-COVID policies that result in travel restrictions and periodic lockdowns in metropolitan areas, September beef exports to China/Hong Kong were still 5% higher year-over-year at 23,517 mt, though well off the record total posted in August (30,806 mt). September export value increased 7% to $217.2 million. January-September exports to the region increased 23% to 217,028 mt, while value was up 34% to just under $2 billion. China/Hong Kong is now the second highest value destination for U.S. beef, trailing only South Korea. It remains the third largest volume market behind Japan and Korea.

September beef export volume to Korea was down 5% from a year ago at 22,120 mt, while export value declined 9% to $188.8 million – the lowest in 15 months. Through September, exports to Korea remained 3% above last year’s record pace at 219,869 mt, with value up 24% to $2.12 billion. Similar to pork, Korea recently opened a 100,000 mt, duty-free quota for imported beef, which helped bolster beef demand amid rising inflation and sharp devaluation of the Korean won. However, the quota also temporarily eliminated U.S. beef’s tariff rate advantage over major competitors. The quota was scheduled to remain open through the end of the year, but it was fully utilized by mid-October.

Declining purchasing power is also a growing obstacle in Japan, where September beef exports totaled 24,520 mt, down 18% from a year ago. Export value was $177.5 million, also down 18%. Beef variety meat exports (mainly tongues and skirts), declined sharply for the second consecutive month, falling 50% from a year ago to 4,104 mt. Japan remains the leading value destination for U.S. beef variety meat exports, and despite a 15% decline in January-September volume (41,649 mt), export value still climbed 23% above last year’s record pace at $421 million. Through September, total beef and beef variety meat exports to Japan totaled 236,718 mt, down 4% from a year ago, while export value increased 8% to $1.85 billion.

Other January-September results for U.S. beef exports include:

Led by record exports to the Dominican Republic and Trinidad and Tobago, and rebounding demand in Jamaica and the Bahamas, beef exports to the Caribbean totaled 21,633 mt, up 23% from the first three quarters of last year. Export value soared 45% to $180.9 million, reflecting a strong recovery in the region’s foodservice and hospitality sectors and expectation of a strong upcoming peak season.

The foodservice sector has also driven a rebound in beef exports to the Middle East, where January-September shipments reached 50,206 mt, up 9% from a year ago, while export value jumped 56% to $230.8 million. For beef muscle cuts, export growth to the region was led by the United Arab Emirates, Kuwait and Qatar. Egypt is a mainstay market for beef variety meat exports and the leading destination for beef livers. Through September, variety meat exports to Egypt were steady with last year’s volume at 35,417 mt, but value climbed 42% to $65.2 million.

While beef exports to Taiwan remain on a record pace in 2022, September shipments declined sharply from last year’s large totals – falling 27% in both volume (3,914 mt) and value ($44.1 million). Through September, exports to Taiwan still climbed 10% to 51,779 mt, valued at $605.5 million (up 28%).

In the ASEAN, beef exports are on a record pace to the Philippines, Singapore, Thailand and Cambodia. Through September, exports to the region increased 12% from a year ago to 48,610 mt, while value jumped 58% to $354.4 million. Although down from the August record, exports to the Philippines remained strong in September, more than tripling last year’s volume (2,328 mt, up 233%) and climbing 97% in value to $13.8 million.

Although beef exports to Colombia took a step back in September (563 mt, down 22% from a year ago), January-September exports remained well above last year’s record pace at 7,253 mt (up 41%). Export value increased 47% to $34.4 million.

September beef export value equated to $418.67 per head of fed slaughter, down 6% from a year ago, but the January-September average was still up 20% to $465.48. Exports accounted for 14.1% of total September beef production and 12.1% for muscle cuts only, down from 15.7% and 13%, respectively, in September 2021. The January-September ratios were a record 15.4% and 13.2%, up from 15.1% and 12.8%, respectively, a year ago.

Lamb muscle cut exports rebound in September

Following a down month, September exports of U.S. lamb muscle cuts rebounded to 269 mt, up 175% from last year’s low volume. Export value totaled $1.31 million, up 67%. Through September, lamb muscle cut exports increased 76% to 1,676 mt, valued at $9.9 million (up 68%). Led by the Netherlands Antilles, Dominican Republic and Bahamas, exports to the Caribbean nearly doubled from a year ago to 787 mt (up 94%) and increased 71% in value to $5.6 million. Exports also increased to Mexico, Canada, the ASEAN region, the Middle East and Panama.

As noted the past two months, USMEF has raised concerns in recent years with USDA about export data collected by the Department of Commerce for lamb variety meat to Mexico. Reported volumes declined dramatically in July, August and September, suggesting that the data reported in prior months and years were disproportionately high. USMEF is therefore focusing year-over-year comparisons on lamb muscle cuts only.

Complete January-September export results for U.S. pork, beef and lamb are available from USMEF's statistics web page.

For questions, please contact Joe Schuele or call 303-547-0030.

NOTES:

Export statistics refer to both muscle cuts and variety meat, unless otherwise noted.

One metric ton (mt) = 2,204.622 pounds.

U.S. pork and beef currently face retaliatory duties in China. In February 2020, China announced a duty exclusion process that allows importers to apply for relief from duties imposed in response to U.S. Section 301 duties. When an application is successful, the rate for U.S. beef can decline to the MFN rate of 12% and the rate for U.S. pork can decline to 37% (the MFN rate plus the 25% Section 232 retaliatory duty, which remains in place).