Export Statistics

USMEF compiles trade statistics from monthly data reported by USDA/FAS and collected by the U.S. Department of Commerce. USMEF includes beef and pork muscle cuts, processed products and variety meat or offals in the trade statistics. Hides and other rendered or inedible products are not included in the data reported by USMEF.

USMEF’s monthly export statistics refer to both muscle cuts and variety meat, unless otherwise noted. Complete historical export data for U.S. pork, beef and lamb are located under the “Monthly Export Archive” tab. Highlights from the latest monthly export data released are located under the “Latest Export Results” tab.

USMEF also provides highlights from the weekly data reported through USDA/FAS’s Export Sales Reporting Program for beef and pork. This data only includes reported exports of boxed muscle cuts (including three or six piece carcasses) and does not include variety meats, further processed products or trim.

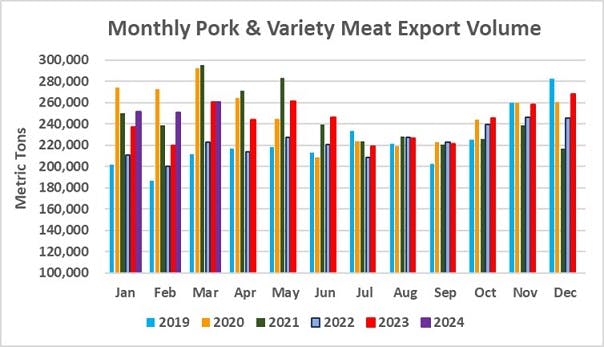

March exports of U.S. pork were steady with last year’s volume and edged higher in value, according to data released by USDA and compiled by the U.S. Meat Export Federation (USMEF). Beef exports were below last March’s large volume but export value was the highest since June 2023.

Pork exports totaled 260,430 metric tons (mt) in March, up 0.1% from a year ago, valued at $740.8 million – up 2% year-over-year and the seventh highest on record. Through the first quarter, pork exports increased 6% to 762,784 mt, while export value climbed 7% to $2.11 billion.

“Another strong month on the pork side, and one that illustrates the importance of export market diversification,” noted USMEF President and CEO Dan Halstrom. “Shipments to Mexico cooled a bit, reflecting the earlier timing for Easter, and yet the global total remained very robust through increases to Korea, Colombia, Central America and Australia. When export value exceeds $70 per head slaughtered, that’s welcome news for pork producers and the entire supply chain.”

March beef exports totaled 108,218 mt, down 10% from the large volume posted a year ago but still the highest of 2024. Export value was $889.9 million, down slightly from a year ago (-0.3%) but the highest in nine months. January-March exports totaled 311,865 mt, down 4% from the first quarter of 2023, but export value increased 6% to $2.48 billion.

“Beef demand in the Caribbean was outstanding in March, and we continued to see a strong rebound in the Middle East as well as some positive signs in Korea and Japan, where the foodservice recovery is making progress,” Halstrom said. “It’s a challenging situation in terms of supply availability, but the value U.S. beef commands internationally is very encouraging – as evidenced by March export value climbing to more than $450 per head.”

Korea shines in March as pork exports close excellent first quarter

South Korea’s demand for U.S. pork continued to build momentum in March, reaching the third largest volume on record at 27,508 mt – up 44% from a year ago – while export value was the second highest on record at $90.6 million (up 54%).

Through the first quarter, exports to Korea climbed 54% above the year-ago pace in volume (69,452 mt) and jumped 59% in value ($227.6 million). After several years in the #5 position for U.S. pork exports, Korea has surpassed Canada as the fourth largest export destination, trailing only Mexico, China and Japan.

Led by record exports to Costa Rica and Nicaragua and larger shipments to Honduras, Guatemala and Panama, March pork exports to Central America increased 28% from a year ago to 13,626 mt, while value soared 41% to $42.5 million. First quarter exports to the region were up 21% to 37,681 mt, valued at $114.8 million (up 31%). For Panama, exports are front-loaded each year because the pork safeguard is quickly triggered, meaning a higher duty on U.S. pork. This year Panama has initiated efforts to restrict overall import volumes.

March pork exports to leading market Mexico were lower year-over-year for the first time in 16 months, mainly reflecting the earlier Easter holiday. Exports fell 11% to 84,808 mt, while value was down 9% to $178.4 million. Shipments to Mexico still finished the first quarter on a record pace, up 4% from a year ago in volume (281,261 mt) and 6% higher in value ($575.1 million).

Other first quarter results for U.S. pork exports include:

March pork export value per head slaughtered soared to $70.85, up 12% from a year ago, the highest in nearly three years and the fifth highest on record. This pushed the first quarter average to $64.25, up 7%. Exports accounted for 32.2% of total March pork production and 27.9% for muscle cuts, up significantly from the year-ago ratios of 29.1% and 25%, respectively. First quarter exports accounted for 29.9% of total production and 25.8% for muscle cuts, up from 28.2% and 24.1%, respectively, a year ago.

With shipments trending sharply higher to both Australia and New Zealand, January-March exports to Oceania climbed 151% from a year ago to 28,271 mt, with value up 139% to $101.8 million. Most U.S. pork entering this region is raw material for further processing, and the U.S. industry has been rapidly regaining market share from the European Union. Value-added processed products from the U.S. have also gained popularity in Oceania.

Robust growth in Colombia fueled a strong first quarter for pork exports to South America, which increased 46% from a year ago to 36,180 mt. Export value jumped 54%, reaching $103.4 million. In Colombia, where most U.S. pork has historically been used for further processing, the U.S. industry continues to make gains in the retail and foodservice sectors. First quarter shipments to Colombia increased 50% to 32,012 mt, while value soared 64% to $88 million. The Colombian peso has recovered from its lows against the U.S. dollar, which helps support purchasing power and importer confidence. Colombia’s hog prices have also remained strong.

First quarter pork exports to Japan trended slightly lower than a year ago, falling 2% to 88,473 mt. Export value was down 1% to $357.6 million, as Japan remained the #2 value destination for U.S. pork, trailing only Mexico.

Despite lower shipments to the Philippines, first quarter exports to the ASEAN region increased 6% from a year ago to 14,811 mt, valued at $31.6 million (down 10%). Exports continued to soar to Malaysia, jumping 170% year-over-year to 1,503 mt, while value increased 163% to $4.6 million. A strong March performance pushed first quarter exports to Vietnam to 1,528 mt, up 78%, while value climbed 87% to $2.9 million.

Large domestic supplies and economic headwinds continue to weigh on China/Hong Kong’s demand for imported pork. In the first quarter, U.S. exports fell 16% from a year ago to 113,248 mt, while export value was down 24% to $266.8 million. The region is the largest destination for U.S. pork variety meat exports, which declined at a less severe pace, falling 4% in volume (82,165 mt) and 14% in value ($195 million).

March bright spots for U.S. beef include Caribbean, Middle East, Mexico

March was one of the best months ever for U.S. beef exports to the Caribbean, where shipments climbed 16% from a year ago to 3,398 mt – the third largest on record. Export value was the second highest on record, climbing 12% to $31.1 million.

This performance was led by record-large exports to the Dominican Republic, which increased 17% from a year ago to 1,238 mt. Export value to the DR soared 30% to a record $15.4 million. First quarter exports to the Caribbean increased 18% in volume (9,037 mt) and 14% in value ($76.4 million). In addition to the DR’s strong performance, first quarter exports increased to the Netherlands Antilles, Leeward-Windward Islands, Cayman Islands, Barbados and Turks and Caicos Islands. Beef variety meats achieved dramatic growth in Trinidad and Tobago.

Following a down year in 2023, the Middle East region’s demand for U.S. beef rebounded impressively in the first quarter. March exports totaled 5,342 mt, up 30% from a year ago, while export value climbed 22% to $22.2 million. First quarter exports to the region increased 41% from a year ago to 14,562 mt, valued at $61.5 million (up 40%). Much of this growth is attributable to larger beef variety meat shipments to Egypt, where March exports were the highest since December 2022. But muscle cut exports also increased dramatically to the United Arab Emirates, Kuwait and Qatar and trended higher to Israel, Bahrain and Jordan.

Although March beef export volume to Mexico fell below the year-ago level for the first time in 15 months, the market still posted a solid performance. March shipments to Mexico totaled 16,628 mt, down 5% from a year ago, while export value increased 3% to $100.2 million. First quarter exports to Mexico increased 12% year-over-year to 56,499 mt, while export value jumped 18% to $333.5 million. Since gaining access last year, Brazil has emerged as the second largest supplier of beef to Mexico.

Other first quarter results for U.S. beef exports include:

March beef export value equated to $454.62 per head of fed slaughter, up 14% from a year ago and the highest since July 2022. The January-March average was $407.91 per head, up 9% from the first quarter of 2023. Exports accounted for 15% of total March beef production and 12.6% for muscle cuts, up from the year-ago ratios of 14.6% and 12.3%, respectively. First quarter exports accounted for 13.9% of total production and 11.6% for muscle cuts, both down slightly from a year ago.

Beef exports to leading market South Korea continue to trend lower than a year ago in volume but still achieve higher value. March exports to Korea totaled 22,105 mt, down 14% year-over-year, but value increased 5% to $211.2 million – the highest since December. First quarter exports to Korea were down 8% to 58,968 mt, while value increased 10% to $553.9 million. For chilled beef, exports were down 4% to 17,550 mt while frozen volume fell nearly 10% to 38,497 mt.

March beef exports to Japan also edged higher in value at $168.6 million, up 1% from a year ago and the highest since August. Although March export volume fell 7% to 21,412 mt, this was the largest total in 12 months. With the persistently weak yen weighing heavily on consumers’ purchasing power, first quarter exports to Japan fell 10% from a year ago to 62,692 mt, though export value was only down slightly (-1%) to $469.7 million. Japan’s central bank took actions over the past week aimed at bolstering the yen’s value, which had recently fallen to its lowest level versus the U.S. dollar since 1990.

Although March beef exports to Central America trended lower in volume (1,751 mt, down 15%), export value still increased 14% to $15.3 million. Led by robust growth in leading market Guatemala and Panama, first quarter exports to the region increased 4% year-over-year to 5,708 mt, while value climbed 15% to $42.5 million.

First quarter beef exports to Canada dipped slightly in volume (22,080 mt, down 1%) from a year ago, but export value increased an impressive 17% to $194.3 million.

Beef exports to Taiwan slumped in March to 3,802 mt, down 33% from a year ago, while value fell 27% to $40.5 million. This pushed first quarter exports to Taiwan 18% below last year’s pace at 12,112 mt, while value fell 6% to $132.7 million.

March beef exports to China/Hong Kong also trended lower in March, falling 13% from a year ago in volume (18,473 mt) and 11% in value ($168.1 million). First quarter exports to the region were down 7% to 51,122 mt, while value was down 2% to $469.8 million.

First quarter lamb exports lower in volume, but value trends higher

March exports of U.S. lamb were 35% below last year at 246 mt, while export value fell 5% to $1.5 million. However, this year-over-year decline was mainly due to a large volume reported for the Middle East in March 2023, as March exports to the Caribbean, Mexico and Canada all trended significantly higher than a year ago.

First quarter lamb exports fell 5% in volume to 819 mt, but value increased 19% to $4.7 million. Value growth was led by the Caribbean, Mexico and Canada, but exports also trended higher to Taiwan and the ASEAN.

Complete first quarter export results for U.S. pork, beef and lamb are available from USMEF's statistics web page.

For questions, please contact Joe Schuele or call 303-547-0030.

NOTES:

Export statistics refer to both muscle cuts and variety meat, unless otherwise noted.

One metric ton (mt) = 2,204.622 pounds.

U.S. pork and beef currently face retaliatory duties in China. In February 2020, China announced a duty exclusion process that allows importers to apply for relief from duties imposed in response to U.S. Section 301 duties. When an application is successful, the rate for U.S. beef can decline to the MFN rate of 12% and the rate for U.S. pork can decline to 37% (the MFN rate plus the 25% Section 232 retaliatory duty, which remains in place).