Evolving Consumption Habits Bode Well for U.S. Pork Among Chinese Middle Class

Joel Haggard, Senior Vice-President, Asia Pacific Region

Jianwen Liu, Director, USMEF-Beijing

Even though China’s economic growth is slowing, a cooperative research project with China Agricultural University funded by USMEF shows there is room for growth in per capita pork consumption among consumers in the world’s largest pork-producing and pork-consuming nation.

The research results suggest that evolving demographics – as well as consumers’ changing pork buying habits – will result in increased purchases of prepackaged, higher quality branded pork sourced from production systems deemed safe. Funded with support from the USDA Market Access Program (MAP), the study was based on interviews with 833 supermarket shoppers in four major Chinese cities.

The study examined Chinese urban consumers’ preferences and attitudes towards pork from different origins of production in four urban areas: Beijing, Shanghai, Chengdu and Guangzhou. These preferences were layered over major demographic variables including age, education level, food safety concerns, and knowledge of frozen, chilled and hot pork. These variables were analyzed to derive an estimate of consumers’ willingness to pay for U.S. pork.

In terms of current supermarket purchasing habits, the study found that hot, freshly harvested domestic pork is still the most favored (50 percent) compared to chilled (40 percent) and frozen (10 percent), a finding that demonstrates the persistence of traditional buying habits, even among urban consumers.

This preference was more notable among residents in the southern cities of Guangzhou and Chengdu, where hot pork purchases accounted for 61 and 57 percent of total pork buying, respectively, while in Beijing and Shanghai, hot pork purchases only account for 27 and 45 percent, respectively.

Interestingly, a large segment of supermarket shoppers still lack clarity on the differences between hot and chilled product. According to the survey, less than 60 percent of the survey respondents stated that they were aware of the availability of chilled pork while only 48 percent claimed that they know the differences between chilled and hot pork.

Urban supermarket shoppers also purchase pork at wet markets. The study found that 40 percent of those interviewed purchased pork at wet markets in addition to supermarkets. Wet markets are viewed as offering the freshest product with flavor unique from local pork that the consumers prefer, an implication which could explain both a strong traditional preference for hot pork as well as consumers’ linking pork freshness with safety.

Pork at modern retail stores is generally sold in two ways: 1) at full-service counters where staff cut from primals according to a customer’s specific order, or 2) in prepackaged or “case ready” form. For the latter, some prepackaged product is delivered to the store already tray-wrapped while, in other cases, sub-primals are further broken down and packaged in store. Prepackaged pork is generally not available in wet markets. Although most consumers still purchase pork at the full-service counters, 20 percent of those surveyed stated they prefer prepackaged product. Prepackaged product is usually branded and carries a price premium versus pork sold at the full-service areas.

The research showed a positive correlation between income levels and the preference to purchase prepackaged pork. Among well-known Chinese local pork brands, the Shuanghui brand is the most recognized with 60 percent of survey respondents saying they have heard of the brand and more than 30 percent having bought its products. Although the percentage of consumers preferring prepacked product is low, it is almost certainly above the level of five years ago, when very little prepackaged product was available.

Supermarket shoppers’ experience with imported pork is very limited, which accounts for the low number of respondents (7 percent) reporting such purchases. In general, consumers prefer to buy local pork over that from outside the municipality or province, but those with higher incomes, whom the research shows are more concerned with food safety, are more willing to spend a premium on product that is deemed safe, regardless of its origin.

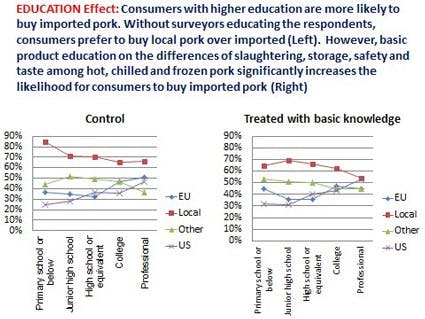

Consumers with higher education also displayed a propensity to buy imported pork but, given that most imported pork offered to shoppers to date is frozen, any perceived advantages of imported pork in quality or safety may be cancelled out by a perception that the pork is not fresh and, specifically, that it is frozen.

The survey found an inverse relationship between preferences for local pork and the level of shopper education. The research contained a willingness-to-pay simulation, which found that educating consumers on basic facts regarding the differences between hot, chilled and frozen pork also lowered the bias against non-local and imported pork. The authors concluded that a “consumer campaign can be an effective approach to promote the market for chilled, frozen and imported pork in urban China. Our findings from this study indicate that young and highly-educated consumers are more open to imported pork.”

USMEF-China is integrating these research findings into its education process with importers, distributors and retailers so that they better understand how consumer habits and attitudes regarding pork are changing.

With the Chinese government’s ambitious plan for continuing urbanization towards 2020 and beyond (70 percent urban population by 2030, according to the United Nations), and a growing middle-class appetite for safe and quality pork products, the U.S. pork industry can potentially increase its market share and sales value in the vast Chinese pork market through continuing education and exposure to U.S. pork products.

Currently, most U.S. pork sold at retail is sold frozen in vacuum-packed, portion-controlled consumer portions. In the future, more chilled U.S. pork is expected to be merchandized, but the CAU research points to the need to continue education of consumers – even in urban areas – who maintain traditional shopping habits and a preference for “local.”

Demographics – including rising income and education levels – coupled with consumer concerns over food safety, point to the need to promote the safety and wholesomeness attributes of U.S. pork aggressively in order to increase awareness and demand.

The main report can be found here.