USMEF Outlook Seminars Held in Mexico, Guatemala

USMEF recently held a series of three seminars for importers, processors and distributors in Mexico and Guatemala to discuss the global and U.S. red meat situation and outlook and USMEF program initiatives for the coming year. The seminars were led by USMEF Economist Erin Borror and USMEF Marketing Manager Gerardo Rodriguez and conducted in Guatemala City, Guadalajara and Mexico City.

USMEF Economist Erin Borror reviewed red meat production and demand trends during “Situation and Outlook 2017 for Red Meats” seminars in Guatemala and Mexico

Borror reviewed the status of U.S. beef and pork production, with growth projected in both sectors. She also explained that the U.S. is increasingly able to offer competitively priced beef and pork to our international customers, as American producers have responded to high price signals over the past several years by expanding production.

Rodriguez presented a new educational tool - the U.S. beef cuts virtual course – and explained how it can benefit companies while helping drive demand for high-quality U.S. beef.

These and other planned USMEF initiatives are expected to play a big role as the U.S. industry works to build continued momentum for red meat exports to Mexico, despite persistent weakness of the peso. New product development will be an important tool in the year ahead to increase sales in Mexico and Central America.

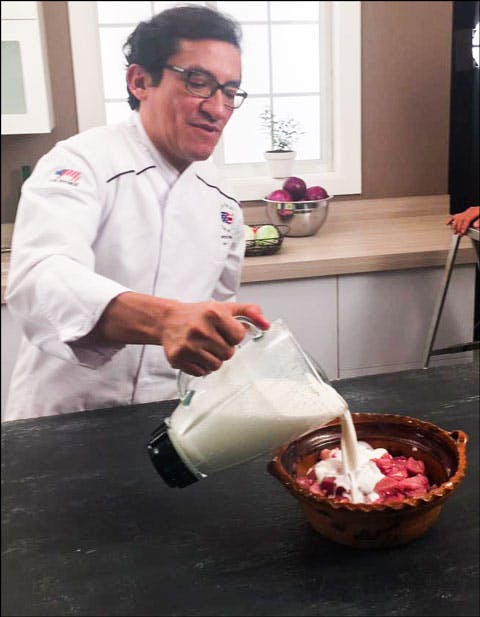

USMEF Chef German Navarette shoots an educational video on preparation of U.S. pork

One example of USMEF’s company-specific marketing strategy is its partnership with BAFAR – the third largest processor in Mexico – to promote U.S. pork hams in 17 regions of the country. New products like U.S. pork bacon-ham, skirt from brisket and U.S. “pork wings” – a new product made from pork shank that competes with chicken wings in sports bars and other casual venues – are also subjects of increased marketing efforts.

A retail poster in Mexico promotes U.S. beef for the upcoming Christmas season

“Exports to Mexico could possibly set a record for the fifth consecutive year, although it will be close and exports might fall a bit short of the massive 2015 volume,” said Borror. She added that exports in August, September and October were up 8 percent, 14 percent, and 9 percent, respectively, compared to last year.

“And all this when ham prices – in pesos – have been up more than 20 percent for the year – not just the huge jump over the past several weeks – but the year-to-date average,” Borror said.

Borror explained that there has been a surge in U.S. pork exports to Mexico, ramping up since late summer. She listed several contributing factors, including: seasonal demand for Christmas and inventory-building before the end of the year; high domestic hog prices, indicating a PED-related hole in supplies; higher prices for turkey; and uncertainty about future conditions. Demand for variety meat also remains especially strong, as Mexico competes with China on several items. Mexico is the leading market for U.S. beef variety meat.

“Especially with the slowing of China’s purchases of muscle cuts, Mexico is the dominant export market for U.S. hams, and the largest market for U.S. pork on a volume basis. Despite significant headwinds, the trade in Mexico seemed cautiously upbeat about the future and they continue to adapt to the weak peso environment. Demand for pork, beef and variety meats remains strong, and Mexico’s domestic production is also growing, so bilateral trade has been beneficial for the industries on both sides, as well as consumers.”

A few statistics Borror shared during her presentations in Guadalajara and Mexico City, in an effort to highlight the importance of the Mexican market to the U.S. industry follow:

- Exports to Mexico account for about 8 percent of U.S. pork production and 3 percent of U.S. beef production.

- Per capita consumption of U.S. pork in Mexico reached 5.65 kg in 2015.

- Pork export value reached $12.42 per capita in 2014 before easing to $10 in 2015-16.

- Beef export value has averaged $8.60 per capita over the past three years (just under 2 kg/ person).

- Total U.S. pork and beef exports to Mexico reached $2.3 billion in 2015, up 37 percent over the past 10 years.