USMEF Economist Addresses Spanish Pork Producers

USMEF Economist Erin Borror recently addressed Spanish pork producers in Lledia, in northeastern Catalonia in the heart of Spain’s main pork-producing region. The conference, which was organized by the Spanish Ministry of Agriculture and the Federation of Cooperatives in Spain, was titled, "Challenges for the Spanish White Pig Industry. Ways of cooperation and associativity of the agri-business cooperatives.” Borror presented a global pork market overview and explained the challenges and opportunities currently faced by the U.S. pork industry.

“I want to thank USDA-Madrid for facilitating such a great opportunity – not only to share information about the U.S. industry, but also to learn more about a rapidly emerging competitor,” Borror said. “Spain is now the No. 1 pig producer in the European Union – although Germany’s pork production still exceeds Spain’s, due to Germany’s piglet imports. Spain has really been the leading force behind the EU’s growth as a pork exporter, especially in the major Asian markets.”

Spanish pork production increased by 7.6 percent in 2015, reaching 3.9 million metric tons (mt). This year production is forecast to exceed 4 million mt, up another 3 to 5 percent. By comparison, Germany’s production increased just 1 percent in 2015 (to 5.56 million mt) and is expected to decline 2 percent this year. Spain’s production will continue to expand in 2017, but likely at a slower rate of 1 to 2 percent. Germany’s annual slaughter remains Europe’s largest at about 58 million head, but Spain continues to close the gap, with its 2016 slaughter expected to exceed 48 million head.

“Adversity has driven integration in the Spanish industry and has spurred efficiency gains in all aspects of production – from more pigs per sow, to lower costs of gain, to customized specifications for customers,” Borror explained. “Their scale is smaller than the U.S., so they have the ability to customize, but not so small that they are inefficient. Russia restricted imports from Spain in early 2013, about one year before the African swine fever-related ban on imports from the entire EU took effect. In retrospect, this actually gave Spanish producers a jump on the Asian markets, as they were forced to diversify ahead of the other major EU exporters. The weak euro also helped them build inroads and sell products they were not previously moving overseas.”

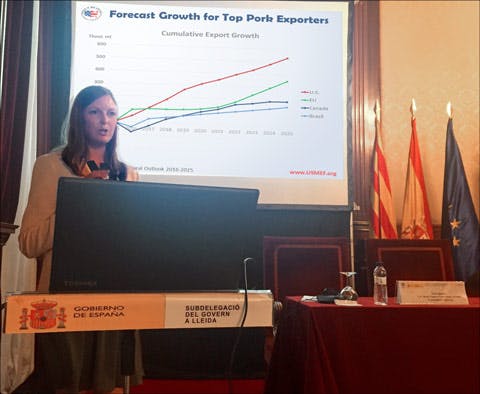

USMEF Economist Erin Borror presents a global market overview to pork industry representatives in Lledia, Spain

Spain’s total pork and pork variety meat exports, including to other EU member states, reached nearly 1.6 million mt in the first half of this year, up 27 percent and on a record pace. Exports to markets outside Europe and Russia have increased nearly four-fold compared to the first half of 2013. About 40 percent of Spain’s exports are currently bound for Asia, compared to less than 20 percent in 2013. China is now its top market, while other primary destinations outside Europe include Japan, Korea, Hong Kong, the Philippines, Taiwan, Vietnam, New Zealand and South Africa. Virtually no Spanish pork was exported to Taiwan, Vietnam or New Zealand in 2013, but now these are among its leading markets.

Spanish pork has a very strong image in the Asian markets, benefiting from its world-famous Iberico and Serrano ham production. Increased tourism to Spain has also boosted international demand for Spanish food. Although Spain’s exports of cured hams are still mainly bound for the other EU member states, their high-value image has certainly contributed to the overall success of Spanish pork exports.

In addition to addressing conference attendees in Lledia, Borror and Felipe Macías, USMEF marketing representative for Europe, also met with wholesalers and other meat industry representatives while in Spain.