Expanded Options for Certifying U.S. Pork Exports to Chile

U.S. exporters have a new option for certifying pork destined for Chile

This week the FSIS Export Library for Chile was updated to add a new trichinae certification option for U.S. pork and pork products. Previously, chilled/frozen pork destined for Chile had to test negative for trichinosis or be treated/frozen under the requirements detailed in the Code of Federal Regulations (9 CFR 318.10). But the Export Library and pork letterhead certificate now provide exporters with three options for certifying pork to Chile, including the new option highlighted below:

- Test negative for trichinosis

- Freeze or treat the product pursuant to 9 CFR 318.10

- NEW OPTION: Product is derived from hogs raised under the Pork Quality Assurance Plus (PQA+) program, as certified under an AMS export verification (EV) program

Exporters should also note changes in the Documentation Requirements section of the Export Library, where additional details are provided on how to complete the pork certificate based on which trichinae mitigation option is used.

To implement this change, the USDA Agricultural Marketing Service’s Quality Assessment Division (QAD) announced a new auditing program for animals raised under the PQA+ program. More details on how to utilize this program are available from the QAD Newsroom.

If you have questions regarding these changes, please email Cheyenne Dixon or call 303-623-6328.

The U.S. pork industry and U.S. trade officials have been working for several years to eliminate Chile’s trichinosis testing requirement, which raises the cost of exporting pork, so this week’s developments are very positive news for U.S. suppliers serving Chile.

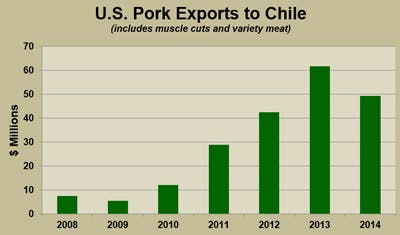

U.S. pork exports to Chile increased rapidly from 2010 through 2013, before retreating somewhat last year when a strong dollar and relatively high U.S. prices made export growth difficult in the face of lower-priced offers from Brazil and Canada. U.S. exports in 2009 were just 1,890 metric tons (mt) valued at $5.5 million, making Chile the 26th-largest value destination for U.S. pork. But by 2013, Chile had climbed to the ninth-largest market with exports of 24,188 mt valued at $61.7 million. In 2014, exports totaled 19,110 mt valued at $49.3 million.

The United States is Chile’s largest supplier of imported pork, holding about 41 percent market share last year. The two primary competitors are Canada (31 percent) and Brazil (21 percent), though the EU also supplies small volumes of pork to Chile.

Because of the transit time between the U.S. and Chile – about 23 days – supplying chilled pork will remain a challenge even with the new PQA+ certification option. However, buyer interest suggests that there is definitely potential for growth in chilled exports. Eliminating the trichinosis test for pork derived from animals raised under the PQA+ program could also provide a boost for frozen exports by reducing the time and cost of getting the product to market.