August Hog Prices Moderate in Most Pork-producing Countries

by Erin Borror, USMEF Economist

After peaking in the early-to-mid summer, hog prices in many of the major pork-producing countries moderated in August. Average prices in July were high in most markets, with the biggest year-over-year increases (measured in U.S. dollars) occurring in Korea (+51 percent), Brazil (+44 percent), Vietnam (+38 percent), the United States (+30 percent) and Canada (+28 percent).

China and the EU were the major exceptions to this trend, as July hog prices in these regions were lower year-over-year. In the case of China, this was due to ample domestic supplies. But China’s hog prices have finally seen a rebound in August, up 13 percent from early July, and are likely headed into a higher seasonal trend, with latest prices averaging $1.06/lb., still trailing year-ago by 8 percent. China’s wholesale imported pork prices also appear to be on the rise, helped by higher local pork prices. Compared to last year, prices are higher for tongues and modestly higher for ears but lower for stomachs and feet. China’s piglet prices have also posted modest increases recently, but are still down nearly 20 percent year-over-year at $1.78/lb. Corn prices are up 6 percent from a year ago at $10.88/bushel.

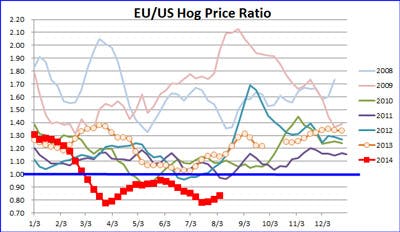

In the EU, prices are still feeling a lingering effect of the African swine fever-related closure of the Russian market, which has been in place since Jan. 30. Hog prices in the EU dipped further in the most recent week of reporting, and are not likely to post a fall rebound as they did the past two years. EU prices are now down 12 percent year-over-year in U.S. dollars (to $99.20/cwt) and 13 percent lower in euro terms. EU prices have been in the unusual position of being lower than U.S. prices since March – at times as much as 20 percent lower. This gap will continue to narrow, however, as U.S. prices move lower.

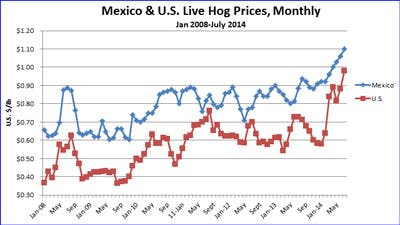

For U.S. pork, the recent rebound in shipments to Russia (prior to the Aug. 7 import ban) was clearly a factor in propelling ham prices to record levels. Now that Russia is closed to both U.S. and Canadian pork, exporters in both countries will likely increase their focus on Mexico as an outlet for hams. Mexico’s live hog prices in July were up 2 percent from June, pushing them 21 percent higher year-over-year (+25 percent in U.S. dollars). The difference between Mexico’s prices and U.S. prices narrowed to 12 percent in July, back to the level seen in April.

PEDV is projected to have a bigger impact on production in the second half of the year in Japan and Korea, but it is still possible that prices in these markets will follow a lower seasonal trend, at least into October. Korea’s hog carcass prices increased for the second straight week (to $2.30/lb and are up 16 percent from a year ago, though still not back to their early July peak).

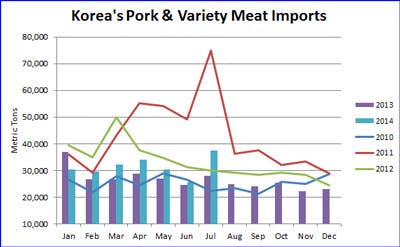

Korea’s pork/pork variety meat imports in July were the largest in more than two years at 37,564 metric tons (mt), with growth led by a surge in imports from Germany (8,238 mt, +156 percent). The combined import total from all EU suppliers was up 77 percent to 22,817 mt. Imports from the U.S. were modestly higher (9,235 mt, +3 percent) while imports were lower from Canada and Chile. For January through July, Korea’s imports were up 10 percent to 220,000 mt, with higher volumes from the EU (102,000 mt, +41 percent) offsetting lower totals from the U.S. (77,000 mt, -1 percent), Canada (19,000 mt, -22 percent) and Chile (15,000 mt, -23 percent).

Bellies accounted for more than half of Korea’s import volume through July (about 86,000 mt), with Germany supplying about one-third of Korea’s belly imports. Mexico is now supplying chilled bellies to Korea, though the U.S. remains the leading supplier at 2,220 mt. The U.S. also still dominates the picnic category, supplying 88 percent of Korea’s 58,000 mt total.

Japan’s hog carcass prices trended lower in July, down 12 percent from their June peak but still up 13 percent year-over-year in yen terms. In U.S. dollars, prices averaged $2.62/lb, up 11 percent. Japan’s Ministry of Agriculture, Forestry and Fisheries expects the fourth-quarter hog supply to be down 5 percent from its normal level due to PEDV, which killed 270,000 piglets in the second quarter of the year.

Like Korea, Japan has imported significantly more pork from the EU this year, as Europe has relied on Asia to offset its loss of the Russian market. Japan’s first half total pork/pork variety meat imports were up 11 percent to 520,193 mt, with larger volumes from all major suppliers: U.S. (220,747 mt, +5 percent), EU (145,996 mt, +26 percent), Canada (86,262 mt, +11 percent) and Mexico (34,500 mt, +19 percent).

Data sources: Global Trade Atlas, China’s Ministry of Agriculture, European Commission, Agriculture and Livestock Industries Corporation of Japan, Mexico’s Secretariat of Economy and Korea Institute for Animal Products Quality Evaluation