A Closer Look at Ecuador, the Latest Market to Reopen to U.S. Beef

Ecuador recently agreed to resume imports of U.S. beef for the first time since December 2003. Ecuador was one of a handful of nations1 that had never reopened after the first U.S. case of BSE, but is now accepting U.S. beef. Exports to Ecuador face very few restrictions, with muscle cuts and offal items from cattle of all ages now eligible.

“That’s a huge bonus in a market where we expect to see demand for offal products,” said Cheyenne Dixon, USMEF technical services manager.

The only constraint is that all products must be produced under an approved AMS export verification (EV) program showing that if Canadian cattle were used, they were in the U.S. a minimum of 60 days prior to slaughter.

“We hope the 60-day restriction on Canadian cattle is temporary, and it is a point on which the U.S. and Ecuadorian governments continue to negotiate,” Dixon explained. “But products derived from all domestic cattle are eligible, as well as beef from all cattle imported from Mexico.”

Ecuador’s population is roughly 15.5 million and its per-capita GDP2 of $9,637 is lower than in neighboring countries (Colombia, $10,436; Peru, $10,765; Venezuela, $13,267; Chile, $22,363). Ecuador’s main tourist destination is the Galapagos Islands, an archipelago located about 600 miles west of the mainland. But tourism along Ecuador’s Pacific coast has also grown in recent years as the area has become well-known for diving and whale-watching.

In addition to providing high-quality beef cuts for Ecuador’s hotel, restaurant and cruise ship sectors, USMEF expects U.S. exporters to find success with variety meat items such as beef tripe and livers. Two introductory seminars for Ecuadorian importers are planned later this month – one in the capital city of Quito and one in Ecuador’s largest city, Guayaquil.

According to the Global Trade Atlas, Ecuador imported 1,006 metric tons of beef last year at a value of $4.5 million – down about 10 percent from 2012. Chile was Ecuador’s leading beef supplier, followed by Uruguay.

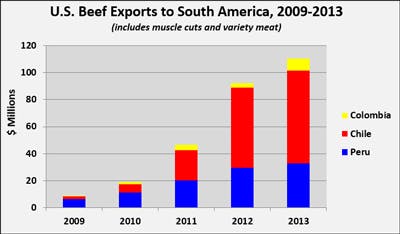

The reopening of Ecuador adds a fourth destination for U.S. beef in the Pacific corridor of South America, where export growth has been remarkable over the past five years. Peru has been a mainstay market in the region for some time, especially as a reliable purchaser of beef variety meat. In 2013, beef/beef variety meat exports to Peru reached record levels of 17,352 metric tons valued at $32.8 million. Chile began to emerge as a major destination for U.S. beef in 2011, following a FMD-related closure to Paraguayan beef and a dwindling of reliable supplies from Argentina. Grain-fed beef has proven popular with Chilean consumers, as U.S. exports last year totaled 12,908 metric tons valued at $68.6 million. Following implementation of the U.S.-Colombia Trade Agreement, U.S. beef exports to Colombia in 2013 nearly tripled over the previous year to 2,734 metric tons valued at $9.1 million.

U.S. pork exporters have achieved growing success in Ecuador in recent years, and in 2013 the United States became the market’s leading pork supplier. However, the process of importing meat into Ecuador is not always smooth. Early last year, agricultural officials in Ecuador began requiring importers of pork, beef, cheese and potatoes produced outside the Andean region to submit import plans to the Ministry of Agriculture for review. As a result, importers reported delays and difficulties obtaining approval. Through the first quarter of 2013, imports of U.S. pork were down about 8 percent from the previous year. But after the issue was raised with the WTO Committee on Import Licensing, pork exports to Ecuador improved through the remainder of 2013 and posted calendar-year records of 2,954 metric tons (+29 percent from 2012) valued at $7.42 million (+36 percent).

1 Markets that remain closed to U.S. beef due to BSE include China, Australia, Argentina, Brazil, Uruguay, Morocco, Israel and South Africa. Saudi Arabia reopened to U.S. beef in 2004, but suspended imports after a BSE case was detected in California in April 2012.

2 Per capita GDP figures are 2012 World Bank estimates, in international dollars using purchasing power parity rates.